| |

|

|

|

|

| President's Message |

" It is a month since GST became applicable. Though the jury is still out on the outcome of GST, a preliminary stock taking would be in order. The SIDBI-FISME toll-free helpline for MSMEs on GST (1800-11-3585) has not stopped ringing since its launch on 7th July. An analysis of the queries raised by MSMEs to the helpline gives us valuable insights into problems faced by them. Almost one fourth of questions pertain to registration, followed by queries on GST compliance procedures for exports and composition scheme. The multiplicity of GST rates left many people confused as people struggled to locate their product or service under a specific tax rate. While holding of trucks at the borders have vanished- a pleasant sight, the State tax agencies are assessing how to check evasion. A few of them are planning of deploying more ‘flying squads’ to check trucks. So bottleneck might shift from borders to roads. MSMEs are also worried about the real prospect of getting their working capital locked up in tax credits. A few MSME segments are troubled by inverted tariff- higher tax on their inputs and lower tax on output, which would lead to accumulation of credit which would take a long time for refund. In case of textiles, the refund is denied outright! That is why people in Surat are agitating. Many MSMEs having business and offices in more than one state have to bear the additional burden of separate GST number and related compliance for each of such state. FISME is collating these anomalies and would raise them at right platforms comprehensively and forcefully in due course. We are also in discussion with banks to find a market based solution of GST induced working capital problems. GST is important and needed. Now is the time to make it work. "

Mr. Dinesh Chandra Tripathi, President, FISME

|

|

| Vol V, Issue 136: August 1, 2017 |

|

|

|

|

|

| Activities |

To create awareness among MSMEs on Goods and Services Tax (GST) and help them in GST compliance, a series of programmes- ‘SMB Connect 2017,’ were conducted across the country by FISME in association with Hewlett Packard India (HP).

HP India along with KPMG has launched "GST Solution", a secure and affordable invoicing platform, for helping millions of traders and micro, small and medium enterprises (MSMEs) migrate smoothly to the GST regime.  "GST Solution" can help users file all their transactions as per the new tax norms in a convenient manner and also reduce the invoice reconciliation requirements of large companies.

In South, these programmes were conducted in Vijaywada along with AP Chamber of Commerce and Industry Federation on 26th June 2017 and in Vishakhapatnam with Vishakhapatnam Auto Manufacturer’s Association on 28th June 2017. Main speakers were from Hewlett Packard (HP) & KPMG.  Another programme in Vishakhaptnam , in association with Visakha Autonagar Small Scale Industries Welfare Association (VASSIWA) was held at VASSIWA hall on 7th July 2017.  The programme was designed with the joint package of HP hardware and KPMG Accounting and Taxation software to create awareness on GST for SMEs to acquaint them on day to day accounting and taxation updates. The welcome address was delivered by Mr. Anne Krishna Balaji, President VASSIWA. Mr.S. K. Shafalan, Deputy Commissioner, Central Excise and Customs, Vizag Central, who was the chief guest of the programme unveiled. “A brief guide to GST for MSMEs”. While delivering the key note address, he listed out the key provisions of the GST and called upon the SMEs to make use of these facilitating provisions.

|

|

|

|

| Business Banter: Lessons from Entrepreneurs |

Google defines an entrepreneur as a person who sets up a business or businesses, taking financial risks in the hope of profit. “Everybody wants to be successful. While some of us want to achieve that goal overnight, some of us prefer to work hard and reach our goals step by step”.

Both the approaches are good, but today you need to work smart and analyse the situation before beginning anything. Even if you are someone who prefers to reach your goal step by step, you need to work in the correct direction, rather than just… working hard at it. Let us look at 5 very basic and important steps that one should follow for successful entrepreneurship.

|

| Writing on the Wall |

The Insolvency and Bankruptcy Code, 2016 (Code) was enacted with the primary objective of consolidating and amending various laws relating to reorganisation and insolvency resolution of corporates, firms and individuals in a time bound manner to maximise the value of their assets. Before the Code, there was no single law dealing with insolvency and bankruptcy in India. As a result, multiple authorities such as the high courts, the Company Law Board, the Board for Industrial and Financial Reconstruction (BIFR) and the Debt Recovery Tribunals (DRT) ...

|

| Media Monitor |

Macro Metre

|

India has started anti-dumping probe into imports of a chemical used in the pharmaceutical industry from four countries -- Russia, South Africa, Kazakhastan and Turkey.

The probe was initiated after a complaint filed by Vishnu Chemicals for investigation into dumping of sodium dichromate from these countries.

The Directorate General of Anti-dumping and Allied Duties (DGAD) has found "sufficient prima facie evidence of dumping" of the chemical.

|

The government is in the process of formulating a Credit Guarantee Scheme for Startups (CGSS) with Rs 2000 crores as the initial corpus for the scheme, Union Minister for Commerce and Industry, Nirmala Sitharaman informed Rajya Sabha.

Under the scheme the entrepreneurs can apply for loan without any collateral for starting their own business units.

The Scheme will provide credit guarantee up to 500 lakhs per business inclusive of term loan, working capital or any other instrument of assistance extended by Member Lending Institutions (MLIs) to finance Startup recognized by Department of Industrial Policy and Promotion (DIPP).

|

India has initiated investigation on a petition by the Indian Solar Manufacturers Association (ISMA) to impose an anti-dumping duty on imported solar equipment.

In its petition to the Directorate of Anti-Dumping & Allied Duties, the association said that solar cell and equipment imports from China, Malaysia and Taiwan are hurting the domestic industry. According to industry watchers, in May 2016, there was a difference of up to ₹65 lakh per MW between domestically sourced, produced panels and imported ones.

|

Finance Minister Arun Jaitley released the National Trade Facilitation Action Plan (NTFAP) on Thursday.

The Action Plan aims to transform cross-border clearance ecosystem through efficient, transparent, risk-based, co-ordinated, digital, seamless and technology driven procedures which are supported by advanced sea ports, airports, and land borders.

The NTFAP aims to achieve improvement in ease of doing business by reducing cargo release time and cost, promote paperless regulatory environment, transparent and predictable legal regime and improved investment climate through better infrastructure.

|

|

|

Government is planning to roll out the much required Direct Benefit Transfer (DBT) for fertilizer subsidies by the end of current financial year for which the preparations are in full swing.

“Government has planned for National Roll Out of DBT for fertilizer subsidies by the end of current financial year. All the preparations for launch of DBT at National level including deployment of PoS machines are in progress as per National Roll Out Action Plan,” Minister of State for Road Transport & Highways, Shipping and Chemicals & Fertilizers, Mansukh L. Mandaviya, informed the Rajya Sabha.

|

With the view to promote clean technology innovations amongst Indian MSMEs, entries have been sought from small and medium enterprises (SMEs) as well as emerging start-ups for the Global Cleantech Innovation Programme (GCIP).

GCIP is run by United Nations Industrial Development organization (UNIDO) in association with world's largest clean technology accelerator (Cleantech Open USA). The Ministry of MSME in partnership with UNIDO launched GCIP in 2013 for promoting Innovations in the Indian SMEs in clean technologies.

|

In a bid to help facilitate expansion of the Micro, Small and Medium Enterprises (MSMEs) of the country, Small Industries Development Bank of India (SIDBI) recently announced full-fledged merchant banking operations.

Through dedicated merchant banking operations’, SIDBi aims to assist MSMEs connect to the capital market including SME Trading Platform as well as Institutional Trading Platforms. In a press interview Ajay Kapur, Deputy Managing Director of SIDBI informed that the bank has supported more than hundred venture capital funds. Through the merchant banking operations, SIDBi will provide support to the MSMEs join the SME exchange portal.

|

The Finance Ministry clarified that the state governments are free to levy certain taxes apart from the imposed Goods and Services Tax (GST) in the country. While the levying of such taxes remain limited to ‘certain’ goods and services as of now, industries fear that it might in the future come down to them in some form or the other.

Talking to KNN, C.K Mohan, Secretary General of the Tamil Nadu Small and Tiny Industries Association (TANSTIA) said that certain states like Tamil Nadu and Maharashtra have already started imposing taxes outside the national Goods and Services Tax (GST). Since the finance ministry has reaffirmed that this is permissible, there is a fear in the industry that in future the states might start imposing taxes on different sectors.

|

With the Goods and Services Tax (GST) almost completing its first month since implementation, the placing of handicrafts under the 12 per cent tax net has adversely impacted the handicraft industry that comprises primarily of the Micro, Small and Medium Enterprises (MSMEs).

Talking to KNN, Lalit Mahajan, President of the Bari Brahamana Industries Association explained the situation of the handicraft industry in Jammu and Kashmir.

|

| State Scan |

Meghalaya

Eyeing at attracting investment opportunities, the State Government has announced Rs 305.79 lakh in the form of projects for the north-eastern state Meghalaya. The prime focus of the program is to promote agro-based industries and encourage rural entrepreneurship in the region.

Under the program, the government will be setting up facilities including industrial shed, common facility centre and labour shed. The program has also outlined different measures such as establishing crèche to help married women take up entrepreneurship.

Panjab

Punjab is hopeful of attracting investments worth Rs 5 lakh crore over the next five years as the Congress-led government is in the process of drafting new industrial policy with special focus on services sector.

Besides, the new industrial policy will also focus on revival of existing industries by promoting a "business first" philosophy.

Haryana

In a bid to encourage research and development in the region, Chief Minister of Haryana Manohar Lal Khattar inaugurated keystone knowledge Part (KKP) in Gurugram recently.

KKP is fully developed knowledge park equipped spreading over 2,25,000 sq. ft. area with a scientific building designed for research and development. Also the park has dedicated plots to be allotted for manufacturing industries. The park will collaborate with industries including biotechnology, food processing, agriculture and pharma.

Odisha

Focus on creating more jobs in the state, Odisha Government has asked concerned departments to prepare credit plan to ensure credit flow to MSME sector and also identify 100 acres of land in the Kalinga Nagar Industrial Cluster to house MSME units.

According to a media report, Chief Secretary A P Padhi asked convener of State Level Banking Committee (SLBC) to prepare a credit plan within a fortnight to ensure smooth flow of loans to MSME in the state.

|

|

|

|

|

|

FISME’s official Twitter handle @fisme |

|

KNN India’s official Twitter handle @knnindia |

|

|

|

| Other Events |

IPCA Electronics India Expo

Date: 03-05 Aug 2017

Venue: Pragati Maidan, New Delhi

See Details

International Conference on Nanoscience and Nanotechnology

Date: 05 Aug 2017

Venue: Classic Sarovar Portico, Thiruvananthapuram

See Details

Woodtech India

Date: 04-06 Aug 2017

Venue: Chennai Trade Centre, Chennai

See Details

India International Optical & Ophthalmology Expo

Date: 4-06 Aug 2017

Venue: Hitex Exhibition Center, Hyderabad

See Details

Food Hospitality World Bangalore

Date: 09-11 Aug 2017

Venue: White Orchid, Bengaluru

See Details

Automation Expo

Date: 09-12 Aug 2017

Venue: Bombay Convention & Exhibition Centre, Mumbai

See Details

World of Concrete India

Delhi Machine Tool Expo

Date: 10-13 Aug 2017

Venue: Pragati Maidan, New Delhi

See Details

India International Gold Convention & Expo

Date: 11-13 Aug 2017

Venue: Grand Hyatt Goa, Bambolim

See Details

Furniture Fair Chennai

Date: 12-15 Aug 2017

Venue: Chennai Trade Centre, Chennai

See Details

|

| Your Views |

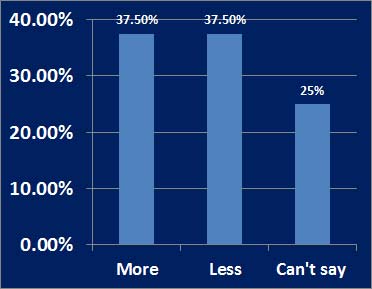

Should the small exporters be allowed to export at zero GST?

According to the FISME Factor, 40 percent of Micro, Small & Medium Enterprises do not agree with the opinion that small exporters should be allowed to export at Zero GST while 60 percent think otherwise.

|

| Knowledge Store |

HR Heuristics

Why Team Building is Essential for Your Business Success

An entrepreneur always looks for solutions; an entrepreneur always looks to forge ahead with his plans and his people. That is where “Teams” come in.

|

Finance Fundamentals

Quitting your job to start a business? Keep these financial tips in mind

As the economy flourishes, choosing to become an entrepreneur to solve a problem with a high conviction has become mainstream in India.

|

|

Marketing Mantras

9 Low-Budget Marketing Strategies Every Startup Can Afford

Startups face many challenges, but none as precarious or life-threatening as the struggle to remain cash positive. The Minority Business Development Agency (MBDA) estimates the average cost to start a business to be in the neighborhood of $30,000; and there’s significant variance in this figure, with some businesses starting out for just a few hundred dollars and others requiring upwards of millions.

|

|

Policy Polemic

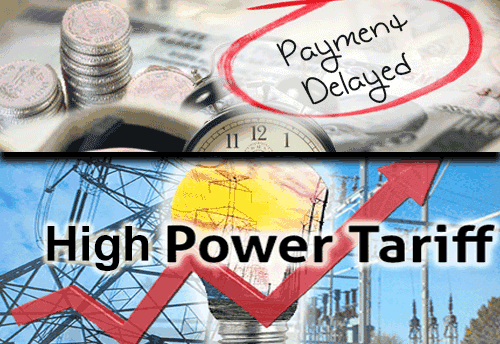

Delayed payments-high power tariffs hampering MSMEs in Andhra: ACCIF

The Micro, Small and Medium Enterprises (MSMEs) continue to face different problems including high power tariffs and delayed payments, because of which the sector is not able to perform well, Andhra Chamber of Commerce and Industry Federation (ACCIF) recently said.

|

|

SME Special

An engineer for the poor, Ayush Semele is a manufacturer without a college degree

Ayush Semele, a 19-year-old from Prithvipur, Bundelkhand, is making headlines for all the right reasons. Even without a formal education at an engineering college, he is being called the ‘Engineer for the Poor’ for developing electronic items for daily use and even tutoring people in manufacturing the devices at very affordable prices.

|

|

Success Story

Sugar Threads brings back childhood memories with gourmet cotton candy

Delhi-based Sugar Threads gives an old product a brand new spin, offering organic cotton candy in over 22 flavours and with an array of toppings. The bootstrapped company now has eight kiosks in North India and aims to make a mark across India.

|

Stockpile

The Central Statistics Office (CSO), Ministry of Statistics and Programme Implementation, has released the Quick Estimates of Index of Industrial Production (IIP) with base 2011-12 for the month of May 2017

|

Quotable Quotes

“ If ethics are poor at the top, that behaviour is copied down through the organization. ”

– Robert Noyce – An American engineer and coinventor of the integrated circuit.

|

| Country Chronicles |

|

FISME regularly receives monthly reports on the economies of various countries from their missions in India. These reports provide information on key economic parameters, trade related information and all news relevant for importers and exporters. In this edition you can take a look at reports on:

|

| New Members |

During the period from 15th July to 31st July 2017 a total of 1 new MSME became members of FISME

|

| Reader Reactions |

Write and Win prize!

Write your comments on the FISME Factor. Share your views and suggestions on MSME issues. Win prize! The best mail will get a special book every fortnight.

send mail to: newsletter@fisme.org.in

|

| Editorial Team: |

Hon. Editor: Anil Bhardwaj

Asstt. Editor: Simmi Nagpal

Types setting & websdesigning: Sanjay Sachan

Video & Photography: Vipul Kumar Chettry

|

|

|

|

You are receiving this Newsletter because you are included in our mailing list of recipients who are involved or interested in FISME or Indian MSMEs. You are welcome to partly or fully reproduce and disseminate the contents of this publication provided that you acknowledge the source.

To subscribe/unsubscribe to this Newsletter

click subscribe or unsubscribe

This Newsletter is edited by the FISME Secretariat. We welcome contributions as well as comments and suggestions. Please write to newsletter@fisme.org.in |

|

|

|

Bangalore

57/5, Family YMCA Building,

Millers Road, Benson Town,

Bangalore - 560046

Tel: +91-80-23543589

Email: bangalore@fisme.org.in

|

Hyderabad

H. No. 6-3-569 / 1/2/4

2nd floor, Rockdale Compound, Somajiguda

Hyderabad – 500082

Tel: +91- 40- 23322117 Fax: +91 -40- 23312116

Email: hyderabad@fisme.org.in

|

Chennai

No. 17/22, 1st floor,

4th Main Road, New Colony, Chromepet

Chennai – 600044

Tel: +91-44-43848805

Email: chennai@fisme.org.in

|

|

| |

Jhandewalan

Tel: +91- 11- 4364 2013

Email: chamber.jw@fisme.org.in

|

Mahipalpur

Tel: +91 -11- 46035866

Email: chamber.mpur@fisme.org.in

|

Kalkaji

Tel: +91 -11- 4106 8644

Email: kalkaji@fisme.org.in

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|