| |

|

|

|

|

| President's Message |

" During December last year, when demonetisation scheme was in full swing, FISME wrote a letter to the Prime Minister. The crux of the communication was that while MSME sector was coming around for paying workers through cheque and other digital means in place of cash, they were in dilemma. Because by doing so the actual number of workers they employed could be revealed and they might be reprimanded for past non-compliance of social security related labour laws. We suggested to the PM that it was an opportune time to announce a scheme which allowed employers to join at the same time providing amnesty for past non-compliance. It was promptly responded to and the PM announced the scheme. But there were glitches at operational level. FISME held a series of meeting with senior officials of Ministry of MSME and the PMO and problems were ironed out. The scheme providing amnesty was extended till 30 June 2017. Last week the numbers of workers who have come on rolls and the Provident Fund after the scheme were published. It crossed 10 million: one crore new workers have joined the formal sector. The impact has been stunning. It is humbling experience for all of us at FISME. It inspires us to continue to improve the business environment for all stake holders. "

Mr. Dinesh Chandra Tripathi, President, FISME

|

|

| Vol V, Issue 135: July 15, 2017 |

|

|

|

|

|

| Activities |

ABP Group and Federation of Indian Micro and Small & Medium Enterprises (FISME) organized INFOCOM 2017 in New Delhi.  The event was inaugurated by Union Minister for Road Transport and Highways Shri Nitin Gadkari. Key themes of the program included Investment opportunities for SMEs, Enhancing credit worthiness of SMEs, Digital India, Entrepreneurship. The Forum was also addressed by the Secretary General of FISME Shri Anil Bhardwaj. Over 250 SMEs participated in the programme.

|

To assist MSME entrepreneurs who are grappling with GST implementation challenges there is a good news. An online support system is launched today with help of which entrepreneurs can have access to expert free advice on GST using either a toll-free number 1800-11-3585 or email.  The answers to queries will be displayed on portal gst4msme.com. The service was launched by Shri S. N. Tripathi, Additional Secretary and Development Commissioner (MSME), Government of India in Lucknow today. Shri Tripathi also launched a Guide for MSMEs on GST. Shri Manoj Mittal, Deputy Managing Director SIDBI mentioned that even after end of a working week, these MSMEs are yet to fully understand the nuances of the GST. A brief guide to GST for MSMEs

|

|

|

|

| Business Banter: Lessons from Entrepreneurs |

The grim reality is that nearly nine out of 10 start-ups fail. But start-ups can dramatically increase their chances of success if entrepreneurs adopt a systematic approach to establish what is called a minimum viable business, asserts Vishwanathan (Vish) Sahasranamam, co-founder and CEO, Forge Accelerator, Coimbatore. His Minimum Viable Business (MVB) framework provides an approach to convert innovative ideas into high-growth and profit-generating enterprises.

|

| Writing on the Wall |

Emphasizing the importance of the Micro, Small and Medium Enterprises the International Trade Center (ITC) recently stated that if the MSME Sector is provided with appropriate support, it can bring an end to poverty in the world by 2030. The Executive Director at ITC, Arancha Gonzalez during an event on the World MSME day made these remarks. He further reiterated that the public as well as private sector organizations must support the MSMEs as MSMEs generate jobs bringing down the unemployment rates in the economy.

|

| Media Monitor |

Macro Metre

|

Share of India's total exports to top 10 destinations worldwide has increased to 51.6 per cent in 2016-17, compared to 49 per cent in 2013-14, industry body PHDCCI today said.

India's main export destinations include the US, Japan, Hong Kong, UAE, China, Singapore, UK and Germany.

The country's merchandise exports to the US grew from $39.14 billion in 2013-14 to $42.33 billion in 2016-17, PHDCCI President Gopal Jiwarajka said in a statement.

|

The government increased import duty on sugar to 50% to curb dumping of the commodity in India as international prices fell.

The industry expects the move to prevent a build-up of arrears in payments to sugar cane farmers in the next season starting October 2017.

Import duty on raw sugar, refined or white sugar that is imported by bulk consumers under tariff head 1701 will increase from the present 40% to 50% with immediate effect, the Central Board of Excise and Customs said in a notification dated July 10. No end date was specified for the duty increase.

|

With increasing use of online and IT systems by the tax authorities, Finance Minister Arun Jaitley on Monday said that an external audit should be done to review how this has lowered physical interface with taxpayers and improved compliance.

“For both direct and indirect taxes, we must get an external audit done to see how much interface has decreased and the areas where further interface can be reduced,” he said at the launch of a new service for income tax queries and payments.

|

S N Tripathi, AS & DC MSME has announced that the 358 products reserved for exclusive purchase from MSMEs will be given preference in Government e-marketplace (GeM).

Tripathi made the announcement while chairing a session on facilitating e-procurement from MSMEs, at a recent workshop on GeM at Delhi.

Government e-marketplace (GeM), is an initiative by the Government to put all buyer Government departments and intending sellers on a e platform.

GeM has provision of the buyers uploading their demand and invite select suppliers to quote on reverse auction mode.

|

|

|

The Food Safety and Standards Authority of India (FSSAI) has operationalized the Food Safety and Standards (Food Products Standards and Food Additives) Amendment Regulations, 2017 relating to standards for Non-carbonated Water Based Beverages (Non-Alcoholic) with effect from July 6, 2017.

The draft regulations regarding the same were notified in October 2016 for inviting comments of the stakeholders.

|

Aiming at encouraging the khadi sector, the Union Minister for Micro, Small and Medium Enterprises (MSME) Kalraj Mishra mooted that the Khadi products might be exempted from the Goods and Services Tax (GST) that was rolled out from July 1.

The Minister made these remarks during a meeting of Khadi Institutions.

Mishra said that in order to encourage the tradition of manufacturing khadi among weavers and spinners, the GST panel is considering revising the tax rate levied on the various products from Khadi industry.

|

The Supreme Court earlier today has put a hold on the notification issued by the Central Government that banned the sale and purchase of cattle from animal market for slaughter. The leather industry that started to turn into a bad shape sees the court order as a big relief for the industry comprising of hundreds of Micro, Small and Medium Enterprise (MSME) units.

Talking to KNN, Asit Baran Kanunga, Vice President of Indian Leather Technologists Association (ILTA) said that the situation for the industry moved from bad to worse ever since the ban notification came out.

|

Post roll out of the Goods and Services tax in the country, there has been a reduction in tax rate on consumer goods. Aiming to ensure that the tax reduction benefit reaches the consumers, the government recently made an appeal to the industry to reduce the prices. Also a Central Monitoring Committee (CMC) has been constituted to monitor the prices and supply post implementation of the Goods and Services Tax (GST).

Hasmukh Adhia, Revenue Secretary made this appeal at the first Central Monitoring Committee meeting.

|

| State Scan |

Haryana

Cooperative Sugar Mills in Haryana have set new records in crushing of sugarcane as well as sugar production during the crushing season 2016-17. The sugar mills have produced 35.50 lakh quintals sugar by crushing 362.04 lakh quintals of sugarcane which is highest since the inception of cooperative sugar mills in the State.

While stating this here today, a spokesman of Cooperation Department said that with a view to ensure transparency in the purchase process, e-procurement system has been implemented by Sugar Fed and Cooperative sugar mills.

Tamil Nadu

The famous peanut candy “Kadlai Mittai” industry of Tamil Nadu raised speculation over the tax rate under the newly implemented Goods and Services Tax (GST). Clarifying doubts over the tax slab in which the item is placed, the officials at Central Excise, Service tax and customs announced 5 per cent tax rate for commodity as against to the rumour of 18 per cent.

The announcement was made during an interaction on GST between the Union Minister of Commerce and Industry Nirmala Sitharaman and other officials from the government and the representatives from various industry bodies.

Punjab

India’s first Technology and Innovation Support Center (TISC) will be set up in Punjab under the World Intellectual Property Organization’s (WIPO) TISC program.

The Department of Industrial Policy and Promotion (DIPP), Ministry of Commerce & Industry signed an Institutional agreement in this regard with the Punjab State Council of Science and Technology.

The Centre would be set up at Patent Information Centre, Punjab.

Uttar Pradesh

Highlighting the importance of MSME sector in Uttar Pradesh, the newly launched state industrial policy bats for improving flow of capital and credit for the sector through measures such as corpus fund to implement Vishwakarma Shram Samman Yojana; Mukhya Mantri Yuva Swarojgar Yojana to help self-entrepreneurship; creation of SME Venture Capital Fund etc .

Given the capacity challenges faced by MSMEs and the volatile market, smooth flow of capital and credit is a sine-qua-non for successful establishment of such units supplemented by government assistance for risk mitigation of the enterprises, highlights the Industrial Policy.

|

| World Watch |

Israel

As many as 12 strategic pacts envisaging investments worth $4.3 billion were signed between Indian and Israeli companies at the first meeting of CEO forum in Tel Aviv today, according to Ficci.

"The forum identified and stressed on the need to realise opportunities in focus sectors identified during the first meeting of CEOs forum. There was a consensus that the current trade volume amounting to just over $4 billion has the potential to reach $20 billion in the next five years. To realise this goal, the forum underlined key recommendations to two heads of states," the industry body said in its statement.

Jordan

During the 10th India-Jordan Morocco Trade and Economic Joint Committee (TEJC) Meeting, the two countries emphasized the need for diversification of bilateral trade and deepening their engagements in different sectors including MSME for greater cooperation in investment sector.

The meeting was held in New Delhi on 4th and 5th July, 2017 under the co-chairs of Nirmala Sitharaman, Minister of State (Independent Charge) for Commerce and Industry, Government of India, and Yarub Qudah, Minister of Industry, Trade and Supply, the Government of the Hashemite Kingdom of Jordan.

Iran

Considering the importance of Micro, Small and Medium Enterprises (MSMEs) in countries across the world, a multi-country observational study mission program on Small and Medium Enterprise Development is being organized in Iran.

The program will take place from 7 till 11 of October this year in Tehran, Iran.

National productivity Council (NPC), that is channelling the program for the Indian MSMEs, has invited applications for participation in the program.

Rwanda

Eyeing at fostering bilateral relations between India and Rwanda through Science- technology and innovation, the India-Rwanda Innovation Growth Program (IRIGP) was launched earlier this year.

As a part of the initial phase of the program in which IRIGP will deploy 20 Indian technologies and innovations in Rwanda, the IRIGP is inviting applications from the Indian techno entrepreneurs.

The program was announced during the visit of the Indian President to Rwanda in February and works on a phase by phase implementation.

|

|

|

|

|

|

FISME’s official Twitter handle @fisme |

|

KNN India’s official Twitter handle @knnindia |

|

|

|

| Other Events |

Agri Intex

Date: 14-17 Jul 2017

Venue: CODISSIA, Coimbatore

See Details

Conference on Industrial Automation

Date: 19 Jul 2017

Venue: Confederation of Indian Industry, Chennai

See Details

Indo Global Skills Summit & Expo Hyderabad

Date: 19 Jul 2017

Venue: Taj Deccan, Hyderabad

See Details

Solar PV ModuleTech India

Date: 21 Jul 2017

Venue: Pride Plaza Hotel Aerocity, New Delhi, New Delhi

See Details

Fabrics & Accessories Trade Show

Date: 20-22 Jul 2017

Venue: Pragati Maidan, New Delhi

See Details

India Jewellery Show

Date: 21-23 Jul 2017

Venue: YMCA International Centre, Ahmedabad

See Details

Cosmo Tech Expo - DELHI

Date: 24-25 Jul 2017

Venue: Pragati Maidan, New Delhi

See Details

Indo-Global Skills Summit & Expo

Date: 28 Jul 2017

Venue: The Lalit New Delhi, New Delhi

See Details

India Machine Tools Show

Venue: 28-31 Jul 2017

Date: Pragati Maidan, New Delhi

See Details

|

| Your Views |

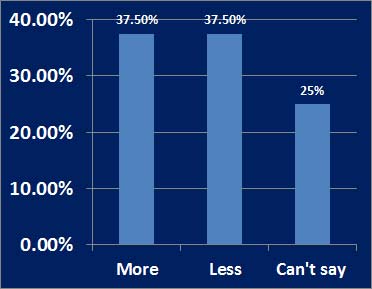

On your product, are you charging more tax in GST regime than earlier (excise + state VAT)?

According to the FISME Factor 37.5 percent of MSMEs think that they are charging less tax on their product and an equal percentage are not sure. Whereas 25% of MSMEs think that they are charging more.

|

| Knowledge Store |

HR Heuristics

Helping your employees stay ahead of the curve

Every organization invests time and money to hire an individual. Starting from the expense to recruit and interview, to training new employees. When an employee resigns, an organization suffers a significant loss – financially as well as morally. Understanding the need of the employees, employers today have introduced various policies and programmes to retain their employees.

|

Finance Fundamentals

Small Business Financing Trends: What You Need to Know

Startup financing is a huge consideration and an important decision for any aspiring entrepreneur. There are plenty of ways to fund a business, and whether you borrow money, dip into your savings or go another route, you need to understand your options before you choose. While these are far from the only ways to finance your startup, here are three of the most popular methods today's entrepreneurs choose.

|

|

Marketing Mantras

9 Sales and Marketing Tips for Startups

Marketing done right can be an incredible boon for your business’s net income. Done wrong, however, it can feel like throwing money into a raging bonfire. Because small business owners have to be whatever their small business needs -- all the time -- it can be difficult to master all the nuances that go into sales or marketing. If you’re not a natural salesperson, it can be even more difficult. Fear not, the following nine marketing tips for startups can help you make more sales, market better and waste less money.

|

|

Policy Polemic

Rs 3000 crore loss, 15 lakh people affected as strike against GST continues in Surat: Traders

Protests against the tax rate on textile under the Goods and Services Tax (GST) entered its 23rd day in Surat. The industry is facing a massive loss of over Rs 3000 crores and there have been no considerable talks yet between the government and the industry.

|

|

SME Special

This startup’s ‘E-Funnel’ ensures users are not duped while purchasing fuel

In the age of malpractices and corruption, one is often bound to get duped into paying more for less. This is something we have always experienced when we are out buying products that don’t come with standard measurements.

|

|

Success Story

Porter wins small business clients with on-demand logistics, lower costs

By all indications, the recently-introduced Goods and Services Tax is expected to benefit the logistics sector, with rating agency ICRA expecting it to grow 9-10 per cent in the medium term. The sector holds promise for a number of start-ups. One of them, Porter, seems to have established a reputation for itself among small businesses. Its on-demand services are reportedly bringing in a healthy share of revenues.

|

Stockpile

The Central Statistics Office (CSO), Ministry of Statistics and Programme Implementation, has released the Quick Estimates of Index of Industrial Production (IIP) with base 2011-12 for the month of May 2017

|

Quotable Quotes

“ I can't change the direction of the wind, but I can adjust my sails to always reach my destination. ”

– Jimmy Ray Dean was an American country music singer, actor, and businessman

|

| Country Chronicles |

|

FISME regularly receives monthly reports on the economies of various countries from their missions in India. These reports provide information on key economic parameters, trade related information and all news relevant for importers and exporters. In this edition you can take a look at reports on:

|

| New Members |

During the period from 1st July to 15th July 2017 a total of 1 new MSME became members of FISME

|

| Reader Reactions |

Write and Win prize!

Write your comments on the FISME Factor. Share your views and suggestions on MSME issues. Win prize! The best mail will get a special book every fortnight.

send mail to: newsletter@fisme.org.in

|

| Editorial Team: |

Hon. Editor: Anil Bhardwaj

Asstt. Editor: Simmi Nagpal

Types setting & websdesigning: Sanjay Sachan

Video & Photography: Vipul Kumar Chettry

|

|

|

|

You are receiving this Newsletter because you are included in our mailing list of recipients who are involved or interested in FISME or Indian MSMEs. You are welcome to partly or fully reproduce and disseminate the contents of this publication provided that you acknowledge the source.

To subscribe/unsubscribe to this Newsletter

click subscribe or unsubscribe

This Newsletter is edited by the FISME Secretariat. We welcome contributions as well as comments and suggestions. Please write to newsletter@fisme.org.in |

|

|

|

Bangalore

57/5, Family YMCA Building,

Millers Road, Benson Town,

Bangalore - 560046

Tel: +91-80-23543589

Email: bangalore@fisme.org.in

|

Hyderabad

H. No. 6-3-569 / 1/2/4

2nd floor, Rockdale Compound, Somajiguda

Hyderabad – 500082

Tel: +91- 40- 23322117 Fax: +91 -40- 23312116

Email: hyderabad@fisme.org.in

|

Chennai

No. 17/22, 1st floor,

4th Main Road, New Colony, Chromepet

Chennai – 600044

Tel: +91-44-43848805

Email: chennai@fisme.org.in

|

|

| |

Jhandewalan

Tel: +91- 11- 4364 2013

Email: chamber.jw@fisme.org.in

|

Mahipalpur

Tel: +91 -11- 46035866

Email: chamber.mpur@fisme.org.in

|

Kalkaji

Tel: +91 -11- 4106 8644

Email: kalkaji@fisme.org.in

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|