| |

|

|

|

|

| President's Message |

Introduction of GST is a watershed event in Indian history. However, businesses- especially small, are undergoing a painful process of adaptation and change. Some of these pain-points are the result of structural flaws in GST design and some because of problems in implementation. Good thing is Government is not rigid and is ready to listen and make amends. Last week, the GST Council formed a Group of Ministers (GOM) to listen to the woes of MSMEs. I had the honour of making a presentation before them along with my colleague Animesh Saxena. I highlighted the need to bring down the GST slabs from five to max. three, delinking credit of tax paid from suppliers’ data entry/ tax payment, abolition of GST on Advance and Stock transfer among other issues. (A link to FISME’s representation is provided the FISME Factor). GST is a major reform and FISME always highlighted its need for industry to become competitive. Let’s continue to keep providing feedback and improve the system "

Mr. Dinesh Chandra Tripathi, President, FISME

|

|

| Vol V, Issue 142: November 1, 2017 |

|

|

|

FISME’s Presentation before Group of Ministers, GST Council |

|

|

|

|

|

|

|

|

| Activities |

Insolvency and Bankruptcy Board of India (IBBI) organised a stakeholder consultation on Individual Insolvency Rights and obligations of Micro, Small and Medium Enterprises (MSMEs) owners, at Ludhiana, recently.

The programme was organised jointly with FISME, the Society of Insolvency Practitioners of India (SIPI) and MSME -Development Institute, Ludhiana.

Suman Saxena, Member of IBBI chaired the session and explained the proposed rules to deal with insolvency of individuals and partnership firms.

The Insolvency and bankruptcy law is a powerful legislation, and the proceedings against the corporate NPAs by the Banks are already making headlines.

|

FISME along with Indian Industries Association, the Insolvency & Bankruptcy Board of India (IBBI) and Society for Insolvency Professionals of India (SIPI) organized a day long round table conference in Lucknow.

The conference explored various dimensions of the IBC including draft rules for individuals in business and also individuals having given guarantees under the new law.

The various stakeholders attending the conference raised suggestions for modifying the rules, which includes raising the threshold limit from Rs. 1000 to at least Rs 1 lakh and giving priority to MSME creditors over big creditors in case of corporate debtors.

|

|

|

|

| Business Banter: Lessons from Entrepreneurs |

I see a strong correlation between setting up a startup and running a marathon. Amidst seasoned athletes, there are many who start a marathon, but only a few are able to run the complete distance. Likewise, there are many budding entrepreneurs who are taking the startup plunge now. Only a few show the persistence to reach the finish line. Both running a marathon and launching a startup test your hard work, determination and perseverance in the pursuit to reach the ultimate objective.

|

| Writing on the Wall |

India's fastest single-year jump in the World Bank's Ease of Doing Business ranking has been a meticulously planned exercise.

|

| Media Monitor |

Macro Metre

|

The index of mineral production of mining and quarrying sector for the month of August (new Series 2011-12=100) 2017 at 92.7, up by 9.4 per cent higher as compared to the level in the month of August 2016.

The cumulative growth for the period April- August 2017-18 over the corresponding period of the previous year has been up by 3.3 per cent.

The total estimated value of mineral production (excluding atomic & minor minerals) in the country during August 2017 was Rs 18,015 crore.

|

The economy is likely to pick up to 6 per cent in the second quarter of the current fiscal, owing to an uptick in several macroeconomic indicators like trade, transport and communication, says a report.

"In the first quarter GDP grew at 5.7 per cent, causing a lot of heartburn, but we strongly believe that the second quarter growth is likely to trend higher and might be in the lower end of 6-6.5 per cent band with an upward bias," SBI Research said in a report today.

|

The number of goods in the highest 28 per cent GST slab would be brought down and a committee of officers will calculate the revenue impact before going in for further reduction in tax rates, Revenue Secretary Hasmukh Adhia said today.

"It is required, the fitment of rates which has happened is mainly based on excise and VAT," he said when asked if the GST Council is considering pruning of the number of items in 28 per cent tax bracket.

|

The Goods and Services Tax (GST) Council has approved rule changes that will allow banks and insurance companies to issue consolidated monthly invoices after the GST Network crashed at peak filing time last month.

This was caused by overloading due to returns being filed with separate invoices for each transaction, vastly exceeding the network's capacity.

"Banks and insurance companies have several transactions with the same client... These can be reflected in a single invoice like it has been done until now," said a government official aware of the development.

|

|

|

The State Bank of India (SBI) on Monday announced sanction of Rs 2,317-crore credit facilities to JSW Energy, Hinduja Renewables, Tata Renewable Energy, Adani Group, Azure Power, Cleantech Solar, and Hero Solar Energy, for executing rooftop solar projects with aggregate capacity of 575 Mw.

The sanction is towards financing grid-connected rooftop solar projects under the SBI-World Bank (WB) Programme. SBI has availed a line of credit of $625 million from World Bank for lending to viable grid-connected rooftop solar projects undertaken by photovolatic (PV) developers and end-users, an official statement said.

|

The government has decided to increase the basic customs duty on polyester fabric to 20 per cent from 10 per cent. Industry experts said this would retain the competitiveness of the domestic manufacturing industry.

The increase will be with effect from October 27, 2017.

Under the Goods and Services Tax (GST) regime, countervailing duty (CVD) has been replaced with IGST and the special additional duty has been scrapped. Polyester fabric attracted 10 per cent basic customs duty, 12.5 per cent CVD and four per cent special additional duty under the pre-GST regime.

|

Voicing the government’s take with reference to the consumer rights and protection in the country, Prime Minister Narendra Modi said that the government is committed in ensuring that the trade in the country happens on fair ground.

The Prime Minister made the following remarks during the inaugural event of the International Conference on Consumer protection organized in association with the United Nations Conference on Trade and Development (UNCTAD).

|

State oil firms have agreed to offer a financial support of Rs 44 crore to about 32 startups working on technological or business innovations that could solve some of oil industry’s problems.

State oil firms signed preliminary pacts with startups, mostly affiliated with IITs, on Wednesday to fund their business proposition. Indian OilBSE 0.19 % signed up with maximum 11 startups, promising to pump in a total of Rs 20 crore in their ventures. ONGCBSE 2.64 % has agreed to fund five startups, GAIL and HPCL four each, Engineers India three, Oil India and Numaligarh Refinery two each and Bharat Petroleum just one startup. The funding commitment ranges from Rs 40 lakh to Rs 2.5 crore for a startup.

|

With the Goods and Services Tax (GST) entering its fourth month, the Micro, Small and Medium Enterprises (MSMEs) have reiterated their demand of zero per cent GST on handmade products with the state government, responding to which CM Siddaramaiah has written to the GST council.

Talking to KNN, Abhilash, convenor of the Gram Seva Sangh explained the latest development along the matter.

He informed that earlier before the coming of the GST, the sector attracted no tax at the input level. This helped the sector fetch some profit in conducting business since the sector largely comprises of the tiny and micro units that don’t run huge profit oriented businesses.

|

| State Scan |

Jharkhand

Union Railway Minister Piyush Goyal on Monday said the Railways was investing Rs 3,500 crore in Jharkhand in the current financial year.

Inaugurating a three-day Global Mining Submit here, Goyal said Jharkhand was on the path of development and Chief Minister Raghubar Das had responded to the Maoist menace positively.

"The chief minister has told us to start work in Maoist-infested areas and promised security," he said.

On the first day of the mining submit, the Jharkhand government and Coal India Ltd signed a MoU to provide drinking water to people from coal mines free of cost.

Tamil Nadu

With the Corporation inspectors issuing show cause notices to the Micro, Small and Medium Enterprises (MSMEs) in the Coimbatore region of Tamil Nadu, charging them for the improper water management, the MSMEs complain that this issuing of notice is another form of harassment by the corporation and shifting of responsibility.

Talking to KNN, C.K Mohan, General Secretary of the Tamil Nadu Small and Tiny Industries Association (TANSTIA) explained the situation.

Assam

The Assam Chief Minister Sarbananda Sonowal, at the inaugural event of the Curtain raiser program of Advantage Assam – Global Investors Summit appealed to the businessmen and investors to come and make in Assam, the state being the land of prosperity.

The Chief Minister made the remarks during the curtain raiser event of the Advantage Assam Summit to be held on 3rd and 4th of February next year in association the Federation of Indian Chambers of Commerce and Industry (FICCI) Guwahati.

Punjab

Despite the assurance by the state government that the power tariff would be locked at 5 rupee per unit for the industrial sector, the sudden rise in the power tariff by over 12 per cent is not in the good taste for the Micro, Small and Medium Enterprises (MSMEs) of the state, Federation of Punjab Small Industries Association (FOPSIA) said.

Badish Jindal, President of FOPSIA informed that after the popular announcement of the government following the roll out of the industrial policy for the state, the industrial sector was hoping relief.

|

|

|

|

|

|

FISME’s official Twitter handle @fisme |

|

KNN India’s official Twitter handle @knnindia |

|

|

|

| Other Events |

Paperex - The World of Paper

Date: 01-04 Nov 2017

Venue: Pragati Maidan, New Delhi

See Details

Aero Expo India

Date: 02-03 Nov 2017

Venue: New ATC Tower IGI Airport, New Delhi

See Details

BUSOFF (Business & Office Expo 2017 - Chennai)

Date: 02-04 Nov 2017

Venue: Alpha City (SSPDL), Navallur, Chennai

See Details

Economic Times Acetech Mumbai

Date: 02-05 Nov 2017

Venue: Bombay Convention & Exhibition Centre, Mumbai

See Details

World Food India

Date: 03-05 Nov 2017

Venue: Vigyan Bhawan, New Delhi

See Details

Expodent Bangalore

Date: 04-05 Nov 2017

Venue: BIEC Bengaluru International Exhibition Centre, Bengaluru

See Details

Finbridge Expo

Date: 04-05 Nov 2017

Venue: Indira Gandhi Stadium Complex, New Delhi

See Details

Interior & Exterior Show

Date: 03-06 Nov 2017

Venue: Chennai Trade Centre, Chennai

See Details

Franchise India

Date: 07-08 Nov 2017

Venue: Pragati Maidan, New Delhi

See Details

Pharmac India

Date: 07-09 Nov 2017

Venue: Gujarat University Exhibition Centre, Ahmedabad

See Details

India Nuclear Energy

Date: 09-10 Nov 2017

Venue: Nehru Science Centre, Mumbai

See Details

Petex India

Date: 11-12 Nov 2017

Venue: Hitex Exhibition Center, Hyderabad

See Details

|

| Your Views |

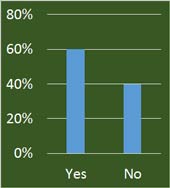

Industrial output for August showing a growth of 4.3 per cent. Do you feel that the growth rate will gear up in upcoming months?

According to the FISME Factor, after 4.3 percent industrial output growth in August, 66.7 percent of Micro, Small & Medium Enterprises think growth will gear up in upcoming months while 33.3 percent think otherwise.

|

| Knowledge Store |

HR Heuristics

Why SMEs on growth trajectory should consider outsourcing HR requirements

SMEs face numerous challenges, but issues around human resources is one of the biggest challenges for small business. In a conversation with ET.com, Sumit Sabharwal, Managing Director (India & SAARC) of Excelity Global spells out challenges SMEs face in the domain of HR and how they can counter it.

|

Finance Fundamentals

How Should Early-stage Start-ups Manage their Finances

When you are starting up, money is almost never your honey. Most start-ups are either bootstrapped or funded by who are properly known as the three Fs – friends, family and fools.

|

|

Marketing Mantras

Why Indian Startups Need to Look Beyond Home Market?

Gone are the days when Indian startups limited themselves to the home country. Wide exposure and thirst for growth have turned catalysts to Indian startups eyeing overseas markets.

|

|

Policy Polemic

Tuticorin salt MSMEs running dry, 25 per cent drop in annual sales: ICCI

The salt industry in the Tuticorin region of Tamil Nadu comprising of primarily the Micro, Small and Medium Enterprises are in a bad state resulting in a dip in sales by over 20-25 per cent, Indian Chamber of Commerce and Industry (ICCI) informed.

|

|

SME Special

This small Kolkata-based manufacturer is giving Modi's Clean Ganga project a big fillip

Cleaning the mighty Ganga is now a National Mission, but the task is not an easy one. Casualty of decades of pollution, Ganga and in fact most water bodies in India are under severe threat of being an ecological disaster.

|

|

Success Story

How Delhi-based Ware is virtualising warehouse space in India

Businesses that are built to solve problems go a long way. Take redBus for example. When Phanindra Sama couldn’t go home for Diwali in 2005, he realised the massive information gap that exists in the road transport industry. When travelling from Bengaluru to Bandipur in a rented car turned out to be a bad experience for Bhavish Aggarwal, he connected with the travel woes of the multitudes and founded Ola.

|

Stockpile

The Central Statistics Office (CSO), Ministry of Statistics and Programme Implementation, has revised the Base Year of the Consumer Price Index (CPI) from 2010=100 to 2012=100 with effect from the release of indices for the month of January 2015.

|

Quotable Quotes

“ There is no such thing as business ethics. There is only one kind -- you have to adhere to the highest standards. ”

– Marvin Bower-An American business theorist and management consultant.

|

| Country Chronicles |

|

According to the FISME Factor, 57.1 percent of Micro, Small & Medium Enterprises think that RBI decision to keep the reverse repo rate unchanged (5.57%) will positively impact MSME while 22.2 percent think this decision will negatively impact MSME and 20 percent can’t say.

|

| New Members |

During the period from 15th October 2017 to 1st November a total of 4 new MSME became members of FISME

|

| Reader Reactions |

Write and Win prize!

Write your comments on the FISME Factor. Share your views and suggestions on MSME issues. Win prize! The best mail will get a special book every fortnight.

send mail to: newsletter@fisme.org.in

|

| Editorial Team: |

Hon. Editor: Anil Bhardwaj

Asstt. Editor: Kalpana Sharma

Types setting & websdesigning: Sanjay Sachan

Video & Photography: Vipul Kumar Chettry

|

|

|

|

You are receiving this Newsletter because you are included in our mailing list of recipients who are involved or interested in FISME or Indian MSMEs. You are welcome to partly or fully reproduce and disseminate the contents of this publication provided that you acknowledge the source.

To subscribe/unsubscribe to this Newsletter

click subscribe or unsubscribe

This Newsletter is edited by the FISME Secretariat. We welcome contributions as well as comments and suggestions. Please write to newsletter@fisme.org.in |

|

|

|

Bangalore

57/5, Family YMCA Building,

Millers Road, Benson Town,

Bangalore - 560046

Tel: +91-80-23543589

Email: bangalore@fisme.org.in

|

Hyderabad

H. No. 6-3-569 / 1/2/4

2nd floor, Rockdale Compound, Somajiguda

Hyderabad – 500082

Tel: +91- 40- 23322117 Fax: +91 -40- 23312116

Email: hyderabad@fisme.org.in

|

Chennai

No. 17/22, 1st floor,

4th Main Road, New Colony, Chromepet

Chennai – 600044

Tel: +91-44-43848805

Email: chennai@fisme.org.in

|

|

| |

Jhandewalan

Tel: +91- 11- 4364 2013

Email: chamber.jw@fisme.org.in

|

Mahipalpur

Tel: +91 -11- 46035866

Email: chamber.mpur@fisme.org.in

|

Kalkaji

Tel: +91 -11- 4106 8644

Email: kalkaji@fisme.org.in

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|