| |

|

|

|

|

| President's Message |

" The magnitude of purchases made by Government agencies or Public Procurement is massive in India. A study conducted by CUTS puts total procurement in India to almost one-third of GDP! That is close to US$ 700 Bn or forty five lac crore. In order to create business opportunities for MSMEs and thus creating more employment, Governments world over found merit in the idea of giving preferential access to MSMEs in it. In India too, 20% of central purchases are earmarked for MSEs (excluding Medium enterprises). Among the government agencies Indian Railways is one of the largest buying agencies. Though Indian Railways does buy a lot of stuff from MSMEs, but many a small entrepreneurs found access in Railways difficult. As Indian Railways is expanding and modernizing, huge new business opportunities are emerging. The Railway Minister Mr. Suresh Prabhu has been very passionate that MSMEs should be enabled to have a greater access of this pie. His initiatives led to a tripartite project where Railways and SIDBI are holding a series of programmes with FISME to expose MSMEs to the opportunities in Railways with a view to expand Railways’ vendor base and creating more business opportunities for MSMEs. The first programme in the series was held in Lucknow. I am happy I could be join hands in flagging off the initiative. "

Mr. Dinesh Chandra Tripathi, President, FISME

|

|

| Vol V, Issue 138: September 1, 2017 |

|

|

|

|

|

| Activities |

The event “Indian Railways-SIDBI MSME Vendor Meet’ was organized at RDSO Complex, Lucknow, recently. SMERA was the co organiser of the programme. FISME was lead industry partner with its state affiliate IIA.

The concept for the fast track for MSMEs participation in Railways Procurement System was laid by the Railways Minister, Shri Suresh Prabhu in at a recent meeting with industry representatives.

|

|

|

|

| Business Banter: Lessons from Entrepreneurs |

The issues arising out of the recent transitions in the Tatas, Infosys and even some political parties highlight what I suspect will be a recurring incident in the times to come, the battle between the patriarchs who have handed over power and the new successors who have taken over.

Breaking this down to its simplistic elements, this occurs when the incumbent partriarch come back to the company that they had stepped down from, under the rationale that the new generation is not doing a good job, (in their opinion) and that they need to come back to save the company from the efforts of the new successor.

|

| Writing on the Wall |

The Ministry of Labour is clearly more ignorant than the young boy at a job fair in Gwalior who told us: “Give me a monthly salary of Rs 4,000 in Gwalior, Rs 6,000 in Gurugram, Rs 9,000 in Delhi, and Rs 18,000 in Mumbai; my bags are packed, so tell me where you want me to go.” The proposal for national minimum wages of Rs 18,000 is like the Mahatma Gandhi National Rural Employment Guarantee Scheme – a rigged benchmark – and will murder formal sector job creation by mandating wages not linked to cost of living.

|

| Media Monitor |

Macro Metre

|

Implementation of goods and services tax (GST) will have a positive impact on state governments’ finances in the medium to long term, according to a report by ratings firm India Ratings. Even in the short term, the impact on individual states varies across states, it said.

GST, a process towards standardisation of taxes across the country, is being criticised for its near term impact on inflation and to some extent impacting states’ autonomy in deciding tax rates.

|

In order to put a check on the rising imports of gold and silver from South Korea, the government has ordered fresh restrictions on the import of these items from the said country.

For an importer to import gold and silver from South Korea, it is now made mandatory to obtain licence from the Directorate General of Foreign Trade (DGFT). The restrictions comes as a response to the reports of rising imports of the gold and silver from South Korea under the free trade agreement between the two countries that was in effect from January 2010. Under the free trade agreement, the basic customs duty was exempted.

|

The Reserve Bank of India (RBI) has blacklisted Punjab based two non-banking financial companies (NBFCs) while 15 others have submitted their certificates to the apex bank.

RBI has cancelled the certificate of registration of - Jalandhar (Punjab) based M/s S.R.F. Hire Purchase Pvt. Ltd and Ludhiana (Punjab) based M/s Mitter Finance Company Limited.

RBI said, “Following the cancellation of registration certificate, these companies cannot transact the business of a non-banking financial institution as laid down under clause (a) of Section 45-I of the Reserve Bank of India Act, 1934.”

|

Making amendment in the Foreign Trade Policy 2015-2020, the Directorate General of Foreign Trade (DGFT) has said status holders shall be entitled to export freely exportable items on free of cost basis for export promotion subject to an annual limit of Rupees one Crore or 2% of average annual export realization during preceding three licensing years, whichever is lower.

However, gems and jewellery and articles of gold and precious metals have been excluded from the freely exportable items list.

|

|

|

With regard to the upcoming new industrial policy for the country, the Department of Industrial Policy and Promotion (DIPP) under the Ministry of Commerce and Industry has asked different stakeholders including the Micro, Small and Medium Enterprises (MSMEs) to engage in the draft.

DIPP informed that the new policy is being drafted under a consultative approach under which various focus groups and an online survey on DIPP website was introduced.

|

In the aftermath of the huge loss to the textile industry of Surat, the sector is facing its second phase of loss due to the slowed distribution of its goods to the main consumer states including Bihar and Uttar Pradesh, especially ahead of festival time.

Manoj Agarwal, President of Federation of Surat Textile Traders Association, in a press interview informed that the situation of the textile industry is beginning to move from bad to wors

|

The Ministry of Micro, Small and Medium Enterprises (MSMEs) in a review meeting reiterated that the MSMEs must utilize the various subsidies given to the sector for availing IT infrastructure and GST software package for transition into the newly implemented Goods and Services Tax (GST).

The Ministry also notified that the MSMEs may avail the benefits under the Digital MSME scheme available for the sector. Under the Digital MSME scheme, the government is offering subsidy on establishing I.T infrastructure and also on obtaining cloud space required for the operation of various accounting software.

|

Centre today asked States to lessen burden of Value Added Tax (VAT) on Petroleum Products used as inputs for manufacturing of goods after the introduction of Goods and Services Tax (GST).

The Union Minister of Finance, Defence and Corporate Affairs, Arun Jaitley has written to State Chief Ministers highlighting a concern being raised by the manufacturing sector in the country regarding the rise in input costs of petroleum products happening on account of transition to Goods and Services Tax regime.

|

| State Scan |

Uttar Pradesh

Uttar Pradesh Chief Minister Yogi Adityanath has said that the state government has arranged for a corpus fund of Rs 1000 crore for the Start-up project.

Addressing the Start-up Yatra 2017 in the state capital on Wednesday, the CM said in the coming days a MoU for this would be signed with the SIDBI in this regard. The Start Up Yatra has been started in 15 districts.

He assured that to encourage the programme, a call centre and a policy implementation app would also be launched.

Assam

In the lines of scrapped Assam preferential stores purchase act, 1989 which gave preferential treatment to small scale industries, BJP led Assam government will bring a new act which will accord preferential treatment to goods produced by MSMEs and small scale industrial units.

Assam industry minister, Chandra Mohan Patwary on Thursday said, “Cabinet note is prepared and a new act which will give preferential treatment to MSMEs and small scale industries of the state will come soon. We are expecting to get it cleared in the cabinet shortly. The new act will be for 10 years.”

Punjab

Eyeing at the industrial development in the state of Punjab with special focus on the Micro, Small and Medium Enterprises (MSMEs), the draft imdustrial policy announced special incentives and packages for the sector. However, the industry is sceptical over the big promises being made to them by the government.

Talking to KNN, Badish Jindal, President of Federation of Punjab Small Industries Association (FOPSIA) explained that while the draft policy that is doing rounds in the sector seems good on the paper, there are real doubts over the substance to the promises that are being made.

Gujarat

In a bid to promote the Micro, Small and Medium Enterprises (MSMEs) in the region, the state government handed over incentives worth Rs 700 crore to over 50 MSMEs of the state.

Highlighting the contribution of the Micro, Small and Medium Enterprises in the state of Gujarat, Chief Minister Vijay Rupani said that the MSMEs are leading the way for the industries in the country.

The CM further informed that at present Gujarat houses more than 6 lakh MSMEs, outnumbering almost all other states in the country. Also the big companies in the country today have mushroomed from a small or a micro unit.

Jammu & Kashmir

Hailing the Centre for extending Central Package of incentives to the industries in Jammu and Kashmir under the GST regime, the Bari Brahmana Industries Association (BBIA) has sought package for existing units, the units which are in the process of process of expansion as well as new units.

The members of BBIA held a meeting in this regard and were thankful to Prime Minister Narendra Modi, Union Finance Minister Arun Jaitley, J&K Chief Minister Mehbooba Mufti and other Ministers for extension of Central Package of incentives to units located in J&K up to March 2027.

|

| World Watch |

Israel

The Union Cabinet today approved a Memorandum of Understanding (MoU) between India and Israel on "India-Israel Industrial R&D and Technological Innovation Fund (I4F)".

The MoU was concluded in July, 2017. It is expected that this will foster and strengthen the eco-system of innovation and techno-entrepreneurship in India and will contribute directly to the Start-up India programme.

Under the MoU India and Israel will make an contribution of USD 4 million each for the Fund, both equivalent amount, annually for five years. The Innovation Fund will be governed by a joint Board which will consist of four members from each country.

Australia

In line with the ongoing flagship Make in India project of the government, Union Steel Minister Birender Singh during a meeting with the visitng Australian Delegation in the national capital, invited the delegation to invest and Make in India.

Listing the various initiatives of the government under the PM Modi, Singh said that there is immense opportunity for Australian investors to explore.

The visiting Australian delegation headed by Australian Assistant Minister for Trade, Tourism and Investment, Keith Pitt, further discussed ways to facilitate collaborations In different areas including steel and mining with the Union Steel Minister.

South Korea

Eyeing at collaboration in different sectors of Indian industry, a business delegation from South Korea visited Indian state of Telangana recently.

The business delegation from South Korea was headed by Kihak Sung of the Korea Federation of Textile Industries. The prime focus of the visit is to explore the potential of collaboration between industries in Telangana and the South Korea, especially the textile sector.

The delegation met Telangana IT Minister K T Rama Rao and discussed the possibilities of investment in the upcoming textile park in the Warangal region of the state.

Sweden

The Union Cabinet has today approved Memorandum of Understanding (MoU) between India and Sweden on cooperation in the field of Intellectual Property (IPRs).

The MoU establishes a wide ranging and flexible mechanism through which both countries can exchange best practices and work together on training programs and technical exchanges to raise awareness on IPRs and better protect intellectual property rights.

|

|

|

|

|

|

FISME’s official Twitter handle @fisme |

|

KNN India’s official Twitter handle @knnindia |

|

|

|

| Other Events |

Furniture Fair Gurgaon

Date: 01-03 Sep 2017

Venue: Huda Ground, Gurgaon

See Details

Agri Asia

Date: 01-03 Sep 2017

Venue: Mahatma Mandir, Gandhinagar, India

See Details

SIAM Convention

Date: 07 Sep 2017

Venue: Taj Palace, New Delhi

See Details

SolarRoofs India Bangalore

Date: 08 Sep 2017

Venue: The Grand Magrath Hotel, Bengaluru

See Details

Fire India

Date: 07-09 Sep 2017

Venue: Bombay Convention & Exhibition Centre, Mumbai

See Details

Surveillance India

Date: 07-09 Sep 2017

Venue: Bombay Convention & Exhibition Centre, Mumbai

See Details

National Drive Electric Week Event Indore

Date: 09 Sep 2017

Venue: Indore Vijay Nagar, Indore

See Details

International Machine Tools Expo

Date: 08-10 Sep 2017

Venue: Bombay Convention & Exhibition Centre, Mumbai

See Details

World of Metal

Date: 08-10 Sep 2017

Venue: Bombay Convention & Exhibition Centre, Mumbai

See Details

Delhi Jewellery & Gem Fair

Date: 09-11 Sep 2017

Venue: Pragati Maidan, New Delhi

See Details

Rubber Dies And Moulds Expo

Date: 13-14 Sep 2017

Venue: Auto Cluster Exhibition Center, Pune

See Details

Techtextil India

Date: 13-15 Sep 2017

Venue: Bombay Convention & Exhibition Centre, Mumbai

See Details

|

| Your Views |

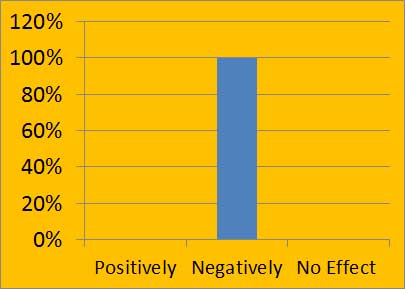

How has GST affected exports from MSMEs ?

According to the FISME Factor, 100 percent of Micro, Small & Medium Enterprises feel that GST has affected export negatively from MSMEs

|

| Knowledge Store |

HR Heuristics

How different is employee engagement from employee experience?

While employee engagement has been a focus area for most organisations for over a decade, employee experience is the new buzz word. Not necessarily contrasting, the two may, at times, be seen as complimenting each other. There is still a lot of confusion around the clear definitions of the two and whether employee engagement and experience are two sides of the same coin.

|

Finance Fundamentals

9 Crucial Things to Consider Before Raising Funds for Your Startup

Are you in the hunt of fundraising to build your startup? Yes, funding is crucial for any startup to nurture their venture. The evolving startup ecosystem has produced a plenty of tangible opportunities for startups to grow. If you’re looking to raise funds, here is a list of ways to raise fund from

|

|

Marketing Mantras

Power of social media: A win-win marketing strategy for SMEs

Traditional media, like newspapers, radio, and television, are effective ways to reach out to large audiences. However, traditional media is broadcast-messages go out, but there is little interaction with the target audience or customers. The information cannot be easily personalized nor is it quick in nature, besides real-time responsiveness is difficult or impossible in most traditional media marketing strategies.

|

|

Policy Polemic

Kerala MSMEs feel choked as land allotted for industries getting diverted to real estate sector

Responding to the news reports of the industrial land being diverted to the real estate sector in the state, the Micro, Small and Medium Enterprises (MSMEs) of the region have raised concern over the issue and said that the land crunch might have negative implications for the industry in the state.

|

|

SME Special

Online platform Shareconomy helps MSMEs find right capacity and accelerate business growth

India has the third largest startup ecosystem in the world. Every year, the nation adds a large number of young engineers/technocrats aspiring to disrupt the market with innovative products. However, lack of funds means budding entrepreneurs often need economical and sustainable solutions for manufacturing. Effective spare capacity utilisation can help eliminate the need for major capital investment.

|

|

Success Story

Tech30 startup Oriano Solar all set to power 120 MWp of projects, sees $25M revenue

They were Oriano Solar had made it to the much-anticipated list of Tech30 companies at TechSparks 2016 because of the founder-trio’s fierce commitment to solar energy even when the odds were stacked against them. The two-year-old startup supplies clean solar power and helps businesses and industries reduce their energy cost – and firmly believes that the electricity cost for the end-consumer can be brought down by 20 to 30 percent, and the power of the existing grids can reach the masses – including remote corners of the country where electricity is otherwise not available – if the solar agenda is truly met with the rigour it deserves from the stakeholders.

|

Stockpile

The Central Statistics Office (CSO), Ministry of Statistics and Programme Implementation, has released the Consumer Price Index Numbers on Base 2012=100 For Rural, Urban and Combined for the month Of July 2017

|

Quotable Quotes

“ The most dangerous poison is the feeling of achievement. The antidote is to every evening think what can be done better tomorrow. ”

– Ingvar Kamprad-a Swedish business magnate and founder of IKEA

|

| Country Chronicles |

|

FISME regularly receives monthly reports on the economies of various countries from their missions in India. These reports provide information on key economic parameters, trade related information and all news relevant for importers and exporters. In this edition you can take a look at reports on:

|

| New Members |

During the period from 15th August to 1st September 2017 a total of 1 new MSME became members of FISME

|

| Reader Reactions |

Write and Win prize!

Write your comments on the FISME Factor. Share your views and suggestions on MSME issues. Win prize! The best mail will get a special book every fortnight.

send mail to: newsletter@fisme.org.in

|

| Editorial Team: |

Hon. Editor: Anil Bhardwaj

Asstt. Editor: Kalpana Sharma

Types setting & websdesigning: Sanjay Sachan

Video & Photography: Vipul Kumar Chettry

|

|

|

|

You are receiving this Newsletter because you are included in our mailing list of recipients who are involved or interested in FISME or Indian MSMEs. You are welcome to partly or fully reproduce and disseminate the contents of this publication provided that you acknowledge the source.

To subscribe/unsubscribe to this Newsletter

click subscribe or unsubscribe

This Newsletter is edited by the FISME Secretariat. We welcome contributions as well as comments and suggestions. Please write to newsletter@fisme.org.in |

|

|

|

Bangalore

57/5, Family YMCA Building,

Millers Road, Benson Town,

Bangalore - 560046

Tel: +91-80-23543589

Email: bangalore@fisme.org.in

|

Hyderabad

H. No. 6-3-569 / 1/2/4

2nd floor, Rockdale Compound, Somajiguda

Hyderabad – 500082

Tel: +91- 40- 23322117 Fax: +91 -40- 23312116

Email: hyderabad@fisme.org.in

|

Chennai

No. 17/22, 1st floor,

4th Main Road, New Colony, Chromepet

Chennai – 600044

Tel: +91-44-43848805

Email: chennai@fisme.org.in

|

|

| |

Jhandewalan

Tel: +91- 11- 4364 2013

Email: chamber.jw@fisme.org.in

|

Mahipalpur

Tel: +91 -11- 46035866

Email: chamber.mpur@fisme.org.in

|

Kalkaji

Tel: +91 -11- 4106 8644

Email: kalkaji@fisme.org.in

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|