| |

|

|

|

|

| President's Message |

The GST Council meeting was held on 28th May after a gap of over six months amidst the razing Covid 2 wave. It was expected that the Council would take bold steps to ease/ reduce compliance burden to help restart of businesses and thus revival of economy. FISME also submitted five point agenda in this regard comprising of issues raised by members viz: i. Variance in GST slab for Auto parts & accessories and suggested they be brought under 18% GST slab. ii. For Input Tax Credit (ITC) accumulation issue we suggested that ITC may be allowed to be converted into tradable instruments (secured) to unlock capital & for reverse charge liability and IGST paid on import, may be allowed from ITC ledger. iii. About difficulties MSMEs face with regards to Principal Place of Business (PPOB) we proposed that MSMEs may be allowed to register e-commerce operator’s warehouses across States. iv. With regards to need for including Services in refund of inverted duty structure we recommend that refund of input tax credit should be allowed where inverted duty structure arises on account of input services. V. To address the difficulties of MSME suppliers to Merchant Exporters we suggested Refund of the remaining GST may be refunded to the manufacturer. It is rather strange that while all members of the Council expressed their grave concerns about the economy, none was willing to undertake reforms or reduce GST rates, perhaps because of fear of fall in revenue. The status quo continues till the next meeting.

"

Animesh Saxena, President, FISME

|

|

| Vol VIV, Issue 228: June 1, 2021 |

|

|

|

|

| Business Banter: Lessons from Entrepreneurs |

Adaptation is a survival strategy that nature has adopted successfully for the most part. As National Geographic notes, adaptation is derived from the challenges an organism faces in its environment. While a business isn't a living organism, it does show a distinct ability to adapt in trying times. The recent Covid-19 pandemic is one of the most considerable challenges that businesses have faced in decades. The combination of uncertainty in the economy and the fear for workers' and colleagues' safety has created a dynamic that has forced businesses to adapt or fail. Businesses have had to change how they operate on a fundamental level if they're to survive. One of the most popular terms that you'll find cropping up in the discussion of these businesses is "pivoting."

|

| Writing on the Wall |

The GST Council, which met last Friday, could not live up to the expectations of some meaningful relief from the disastrous second wave of the pandemic. The measures unveiled were insipid, be it for the common man hoping to survive while keeping fingers crossed for a vaccination slot or a hospital bed, or businesses hurting from lockdowns, and States grappling with a cash crunch amid a scramble to purchase vaccines.

|

| Media Monitor |

Macro Metre |

The Central Board of Indirect Taxes and Customs (CBIC) has extended the deadline for filing monthly Goods and Services Tax (GST) sales returns for May by 15 days till June 26.

The Board has extended the deadline to 26th June as per the decision taken by the GST Council chaired by the Union Finance Minister and composed of state counterparts, resolved to prolong some compliance relaxations due to COVID-19.

|

India attracted the highest ever total Foreign Direct Investment (FDI) inflow of 81.72 billion dollars during 2020-21 which is 10 per cent more than the last financial year, the Ministry of Commerce & Industry said.

FDI equity inflow grew by 19 per cent in the F.Y. 2020-21 (59.64 billion dollars) compared to the previous year F.Y. 2019-20 (49.98 billion dollars). "Measures taken by the Government on the fronts of Foreign Direct Investment (FDI) policy reforms, investment facilitation and ease of doing business have resulted in increased FDI inflows into the country," it further said in its statement on Monday.

|

The Central Board of Direct Taxes (CBDT) has extended the last date to file income tax returns (ITR) for the financial year (FY) 2020-21 or assessment year (AY) 2021-22, by two months to September 30, 2021.

According to a circular by the CBDT, the decision was taken in view of the COVID second wave cases, which has seen India record more daily cases and related deaths anywhere in the world since the beginning of the pandemic. “The Central Board of Direct Taxes, in exercise of its power under section 119 of the Income-Tax Act, 1961 (herein referred to as the “Act”) provides relaxation in respect of the following compliances,” the circular dated May 20th said.

|

|

|

The Ministry of Labour and Employment has announced additional benefits for workers through ESIC and EPFO schemes.

These benefits include a hike in maximum sum assured under the Employees’ Deposit Linked Insurance Scheme (EDLI) under EPFO to Rs 7 lakh from Rs 6 lakh. "The Ministry of Labour and Employment has announced additional benefits for workers through ESIC and EPFO schemes to address the fear and anxiety of workers about wellbeing of their family members due to increase in incidences of death due to COVID-19 pandemic," the ministry said in a statement on Sunday.

|

In a bid to support MSMEs, the Central Government has expanded the scope of the Emergency Credit Line Guarantee Scheme (ECLGS) to September 30, 2021, from June 30, 2021, or till guarantees for an amount of Rs 3 lakh crore are issued.

According to an official statement from the Finance Ministry, under 'ECLGS 4.0', 100 per cent guarantee cover will be extended to loans of up to Rs 2 crore given to hospitals, nursing homes, clinics, medical colleges for setting up on-site oxygen generation plants.

|

Flipkart has further expanded benefits under its seller financing program, ‘Flipkart Growth Capital’, for its sellers to raise credit ranging from Rs 5 lakh to Rs 5 crore.

The e-commerce company on Friday said in order to provide the benefits, Flipkart has partnered with multiple lenders, based on the business needs of sellers. The new program enables sellers to get secured and unsecured loans at interest as low as 9 per cent. The e-commerce giant claims that with the help of tech synergies, sanctions happen instantly and disbursals within 24 hours of the application.

|

All-India Consumer Price Index for Industrial Workers for April, 2021 increased to 120.1 points compared to 119.6 points for March, 2021, said the Ministry of Labour & Employment.

"The All-India CPI-IW for April, 2021 increased by 0.5 points and stood at 120.1," the ministry said in a statement on Monday. ''The increase observed in index is mainly due to items like Arhar Dal, Masur Dal, Fish Fresh, Goat Meat, Poultry Chicken, Eggs-Hen, Edible Oils, Apple, Banana, Grapes, Leechi, Orange, Papaya, Tea Leaf, Tea Hot-drink, Barber/Beautician Charges, Flowers/Flower Garlands, Doctor’s Fee, Rail Fare, Servicing Charges of Motorcycle, Cable Charges, etc. which experienced an increase in prices,'' it added.

|

| State Scan |

Tamil Nadu

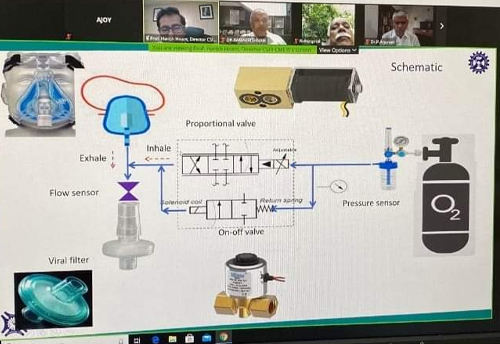

Director, MSME-DI, Chennai, S S Babuji has appreciated the CSIR-CMERI Oxygen Technology and assured that MSME-DI office will provide all assistance to the MSMEs for adopting and rolling out the technology in the markets.

He said during a webinar on ‘Oxygen Enrichment Technology' on Saturday which was organised in association with the Indian Medical Association, Tamil Nadu, for the Doctors and Associate Medical Fraternity.

Maharashtra

The Indian Institute of Management (IIM) Nagpur has signed a Memorandum of Understanding (MoU) with the National Institute for Micro, Small and Medium Enterprises (Ni-MSME), Hyderabad.

The MoU was signed by director IIM Nagpur, Dr Bhimaraya Metri and Director General, Ni-MSME, S Glory Swarupa in the presence of advisor, National Highways Authority of India and Member, IIMN Board of Governors, Vaibhav Dange and staff of both institutions.

Karnataka

Karnataka Small Scale Industries Association (KASSIA) led a delegation to the state Chief Minister BS Yediyurappa and asked him to allow Micro, Small and Medium Enterprises (MSMEs) to operate amid COVID induced lockdown.

KASSIA president, KB Arasappa also urged the Chief Minister to help the ailing MSMEs in the state and appealed to the government to not disconnect or shut down MSME units for non-payment of power bills.

Haryana

Investment in Micro, Small and Medium Enterprises (MSME) is increasing and entrepreneurs are showing interest in investing in Haryana, said the state Deputy Chief Minister Dushyant Chautala.

Addressing a virtual MSME dialogue series organised by the Associated Chambers of Commerce and Industry of India (Assocham) on Friday, he said that with the help of big industries such as JCB, Maruti, Flipkart, ATL, and Honda, small industries in the state are growing.

|

|

|

|

|

|

FISME’s official Twitter handle @fisme |

|

KNN India’s official Twitter handle @knnindia |

|

|

|

| Your Views |

Do you think that the measures announced by the RBI can help restructuring stressed MSME accounts?

According to the FISME factor, 100% of MSMEs can’t say that the measures announced by the RBI can help restructuring stressed MSME accounts. |

| Knowledge Store |

HR Heuristics

5 Human Resource Challenges Facing Small Businesses Today

Unfortunately, there are no shortcuts when it comes to effective HR management. So, if you are an entrepreneur who plans to hire employees, do yourself a favor. Consider these five HR challenges in making sure you are compliant in all aspects of your business.

|

Finance Fundamentals

10 Useful Financial Tips All Businesses Should Follow

Financial management is an indispensable part of every business, big or small. Contrary to what most people think, financial management is much more than simply bookkeeping and balancing the business checking account.

|

|

Marketing Mantras

Follow These 6 Basic Marketing Rules To Succeed

There are just a few plain and simple direct-marketing rules to follow, and by committing to them, you’ll reap the long-term benefits you desire and develop a long-lasting business foundation.

|

|

Policy Polemic

MSMEs in J&K demands oxygen for their operations

Micro, Small and Medium Enterprises (MSMEs) in Jammu and Kashmir (J&K) have demanded to supply oxygen to industrial units.

The MSMEs made the demand during a meeting of Bari Brahmana Industries Association (BBIA) held under the President ship of Lalit Mahajan on Friday to discuss the non-availability of oxygen to a number of industrial units.

|

|

SME Special

This organic farming startup is changing the way we eat and helping farmers with better income

“You are what you eat.” This famous phrase captures the essence of healthy eating, and there is an increased shift towards consuming foods that are organic and chemical-free. The demand for such produce has sparked the interest of entrepreneurs to cultivate organic food.

|

|

Success Story

How this bootstrapped eco-friendly baby care brand clocked Rs 22 Cr turnover in the pandemic year

Started with a personal investment of Rs 10 lakhs and two years of rigorous R&D, Mother Sparsh — a brand synonymous with plant-based, natural and eco-friendly baby care products — has achieved an annual turnover of approximately Rs 22 crore for the financial year 2021.

|

Stockpile

The National Statistical Office (NSO), Ministry of Statistics and Programme Implementation (MoSPI) has released the Provisional Estimates of National Income for the financial year 2020-21, both at Constant (2011-12) and Current Prices.

|

Quotable Quotes

“ Opportunity is missed by most people because it is dressed in overalls and looks like work.

”

– - Thomas Alva Edison - American Inventor & Businessman

|

| Country Chronicles |

|

FISME regularly receives monthly reports on the economies of various countries from their missions in India. These reports provide information on key economic parameters, trade related information and all news relevant for importers and exporters. In this edition you can take a look at reports on:

|

| New Members |

4 new MSME became members of FISME during the period from 15th May 2021 to 31st May 2021

|

| Reader Reactions |

Write and Win prize!

Write your comments on the FISME Factor. Share your views and suggestions on MSME issues. Win prize! The best mail will get a special book every fortnight.

send mail to: newsletter@fisme.org.in

|

| Editorial Team: |

Hon. Editor: Anil Bhardwaj

Asstt. Editor: Kalpana Sharma

Types setting & websdesigning: Sanjay Sachan

Video & Photography: Subhan Khan

|

|

|

|

You are receiving this Newsletter because you are included in our mailing list of recipients who are involved or interested in FISME or Indian MSMEs. You are welcome to partly or fully reproduce and disseminate the contents of this publication provided that you acknowledge the source.

To subscribe/unsubscribe to this Newsletter

click subscribe or unsubscribe

This Newsletter is edited by the FISME Secretariat. We welcome contributions as well as comments and suggestions. Please write to newsletter@fisme.org.in |

|

|

|

Bangalore

57/5, Family YMCA Building,

Millers Road, Benson Town,

Bangalore - 560046

Tel: +91-80-23543589

Email: bangalore@fisme.org.in |

Hyderabad

H. No. 6-3-569 / 1/2/4

2nd floor, Rockdale Compound, Somajiguda

Hyderabad – 500082

Tel: +91- 40- 23322117 Fax: +91 -40- 23312116

Email: hyderabad@fisme.org.in |

|

|

| |

Jhandewalan

Tel: +91- 11- 4364 2013

Email: chamber.jw@fisme.org.in |

Mahipalpur

Tel: +91 -11- 46035866

Email: chamber.mpur@fisme.org.in |

Kalkaji

Tel: +91 -11- 4106 8644

Email: kalkaji@fisme.org.in |

|

|

|

|

|

|

|

|

|

|

|

|

|

|