President's Message

" There is no one-fit-all solution! We need to prepare a detailed matrix that matches different types of MSMEs with different but relevant policy/public supports to help overcome different inherent weaknesses of different MSME groups which may arise due to size, location, capacity, capability etc and have to be responded to accordingly.

"

|

|

Avnet X-fest 2012

Date:July-August, 2012

Venue: Various cities across Asia

See Details

Electronics Rocks 2012

NCEDAR 2012

|

|

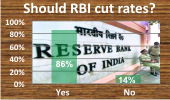

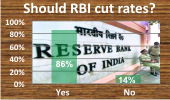

RBI should cut rates in its review on July 31, 2012: Survey

According to The FISME Factor survey, an overwhelming majority of MSMEs, 86%, think the RBI should cut rates in its monetary policy review scheduled for July 31, 2012.

|

|

Dear Readers,

As far as industry is concerned, the verdict is clear. The RBI should cut interest rates to stimulate industrial activity. Our survey of the mood among Indian MSMEs clearly indicates overwhelming support for a rate cut. All indications, however, point to RBI governor sticking to its hard money policy to curb inflation. Interestingly, a recent presentation by a senior banker to FISME has highlighted the critical role that business to business trade credit plays in the economy. New social values and ethics arising from an erosion of confidence has led to the mind-set that cash is king and as a consequence businesses are unwilling to offer trade credit as readily as they used to do in the past. Small businesses which really more on such B2B trade credit rather than bank credit have been severely impacted by this trend. There is, therefore, a need to restore confidence among businesses to boost the flow of B2B trade credit. Our survey this time seeks to gauge the mood of MSMEs on this issue.

Editor |

|

Banking Baatein

Is collateral security necessary for Bank Loans?

The framework laid down by the Central government and the Reserve Bank of India with regard to lending to the small and medium enterprises sector has replaced security-oriented lending by purpose-oriented lending. Under this, bank loans and interest thereto are to be repaid from a unit’s operations and not from any hypothecated security. So, banks should not ask for collateral security when sanctioning loans to MSMEs, argues our banking consultant T.R Radhakrishnan.

Policy Polemic

Jittery prices melt Ghaziabad rubber Inc

Despite a fall in international prices of rubber, local rubber goods manufacturers have nothing to cheer about. Business volumes are down, domestic rubber prices are fluctuating sharply, there is tough competition from Chinese and Indonesian rubber products and a weak rupee has made imports too costly. The way out is for government to allow duty free import of 1.5-2 lakh tonnes of rubber, say rubber product manufacturers.

Finance Fundamentals

Room rent capping in Group Health Insurance

Room rent restriction is one of the clauses of Group Health Insurance that often clients or buyers find difficult to understand. Given the way hospitalization costs are linked to ‘room type’ in India, this restriction is often the most important clause that causes difficulties to lay persons. Please see below an example of the kind of difficulties this clause poses and how we can structure our Group Health Insurance accordingly.

Marketing Mantras

Social Media for SMEs and startups

Social Media expert Prateek Shah writes on how SMEs can benefit from using social media for brand building and marketing.

|

|

Directory of Testing Laboratories in India

Buy our one-of-a-kind guide to all industrial testing laboratories in India. Find the one most convenient for getting your products tested and certified. An invaluable compendium for all industrial units and exporters.

PP: 894, Hard Cover.

Price: Rs 900.

50% discount for members.

Handbook for Managing Export Payment Risks

If you are an exporter you simply cannot do without this unique publication which tells you how to manage payment and other risks arising from exports.

PP: 78.

Price: Rs 300.

50% discount for members.

Free Publications

Fertilizer quality control in India: Need for change

This monograph argues for a systemic change in fertiliser quality control. Essential reading for those in policy-making positions.

|

|

|

FISME regularly receives monthly reports on the economies of various countries from their missions in India. These reports provide information on key economic parameters, trade related information and all news relevant for importers and exporters. In this edition you can take a look at reports on:

|

|

|

|

Activities

Macro Metre

Domestic Digest

World Watch

Knowledge Store

...And A Lot More

|

|

|

A delegation of FISME led by President Shri V.K. Agarwal met Shri Vilasrao Deshmukh, Hon’ble Minister of Science and Technology and also holding additional charge of Ministry of MSME.

Shri Deshmukh emphasized the need to augment manufacturing as it was essential for creating more jobs. He said that MSMEs are a priority for the Government and he promised his full support to them. He also agreed to preside over FISME’s flagship regional event - the India MSME Summit (Western Region) in Mumbai in September this year.

With the demand for redefining Indian MSMEs gaining ground among various sections of the Indian MSME fraternity, FISME organised a Roundtable on “Revisiting MSME Definition” in New Delhi on July 16, 2012. The Roundtable was attended by, among others, Mr N.K. Maini, DMD, SIDBI, Dr Dinesh Awasthi, Director, Entrepreneurship Development Institute, Dr J.S. Juneja, Chairman, MSME Task Force (PHDCCI), and several representatives of industry bodies and banks. The Roundtable produced a rich exchange of views and ideas and FISME would soon collate the various views presented for further discussion before finalising its recommendations to the government on this subject.

FISME held its Annual General Meeting in New Delhi on July 16. The participants reviewed the Draft Annual Activity Report and deliberated on the focus areas to be taken up in the current year. FISME held its Annual General Meeting in New Delhi on July 16. The participants reviewed the Draft Annual Activity Report and deliberated on the focus areas to be taken up in the current year.

For the latest news on the MSME sector in India and elsewhere in the world just visit the FISME website (www.fisme.org.in). It now offers a 24X7 newsfeed covering all MSME-related news across the world. Just log in and check out. For the latest news on the MSME sector in India and elsewhere in the world just visit the FISME website (www.fisme.org.in). It now offers a 24X7 newsfeed covering all MSME-related news across the world. Just log in and check out.

The website of the Intellectual Property Facilitation Centre of FISME now offers a 24X7 newsfeed on Intellectual Property Rights news across the world. To the best of our knowledge, this is the only Indian website which offers a one-stop shop for all IPR news updated on a real-time basis. Just login to the website and check out. The website of the Intellectual Property Facilitation Centre of FISME now offers a 24X7 newsfeed on Intellectual Property Rights news across the world. To the best of our knowledge, this is the only Indian website which offers a one-stop shop for all IPR news updated on a real-time basis. Just login to the website and check out.

|

Do you think your business partners are now giving you less trade credit and for shorter tenures than in the past?

|

Planning Commission survey on business environment

On behalf of the Planning Commission of India, the Institute for Competitiveness, New Delhi, is conducting a survey of Indian micro, small and medium enterprises to assess the business environment of each state of India. The response to the questionnaire will help the Indian government to formulate policies for improving business conditions in every state and enhancing the overall competitiveness of the country. All MSME readers are requested to enthusiastically respond to the questionnaire. The questionnaire is available at http://competitiveness.in/india-competitiveness/planning-commission or Download Questionnaire and will take around 20 minutes to fill up. |

|

|

|

|

|

Macro Metre

Inflation eased marginally in June but pressure on food prices remained which could make it difficult for the central bank to cut interest rates when it reviews policy later this month. "The annual rate of inflation, based on monthly WPI, stood at 7.25% for June, 2012, compared to 7.55% for the previous month and 9.51% during the corresponding month of the previous year," a government statement said. "Build up inflation in the financial year so far was 1.99% compared to a build-up of 2.41% in the corresponding period of the previous year." The government revised upwards the April inflation number to 7.50% from the previously reported 7.23% that also signalled the extent of price pressures.

Factory output grew 2.4 per cent in May, much lower than the growth of 6.2 per cent in the same month last year. The silver lining was that the latest index of industrial production (IIP) growth performance was better than the revised (-) 0.9 per cent for April and (-) 3.2 per cent level of March. The Central Statistics Office had earlier pegged the April industrial growth at a near-zero level of 0.1 per cent.

India's exports fell sharply for the second consecutive month in June due to weak demands in North America and European countries, a senior government official said recently. Exports dropped by 5.45 percent to $25.07 billion in June, while imports fell by 13.46 percent to $35.37 billion, leaving a trade deficit of $10.3 billion, Director General of Foreign Trade Anup Pujari told reporters.

The Small Industries Development Bank of India (SIDBI) is ready to fund domestic MSMEs to acquire foreign companies, a top bank official has said. "We are ready to fund small and medium companies to acquire foreign assets. We will be funding the acquisition value plus the facilitation charges. The money will come from the Rs 600-crore India Opportunity Fund that we have just launched," SIDBI Deputy Managing Director N K Maini told PTI.

|

Small and medium enterprises will benefit from the Factoring Regulation Act, 2012, the Small Industries Development Bank of India has said. Factoring can help Micro, Small and Medium Enterprises to do business in new ways, said Mr N.K. Maini, deputy managing director, SIDBI. He was speaking at a factoring awareness seminar for MSME manufacturers.

The Small and Medium Enterprises (SMEs) need 'money and credit' that can enable them to invest in new products, new technologies and new markets, said Arun Maira, Member of Planning Commission recently. "To invest in something new, they (SMEs) need money and credit to do so. On the money side, there are two things. One is the SME exchange, which enables them to get small amount of money. The other is the credit growth from the banking sector to the SMEs that enable companies to invest in new products, new technology and new markets," he said on the side-lines of a launch of Millennium Alliance: India-US Innovation Partnership for Global Development.

The Reserve Bank of India has asked banks and financial institutions to follow the “guidelines in letter and spirit” for providing credit to the MSME sector. RBI Deputy Governor Anand Sinha said the central bank had issued instructions to all banks for ensuring timely flow of credit to the MSME sector, particularly the more employment-intensive units.

|

Indian Small and Medium Enterprises (SMEs) have started taking advantage of the cloud services but they are facing several challenges when it comes to fully capitalizing on the economic benefits of the cloud, said the industry experts. "The use of cloud computing has just started. For example, the Customer Relationship Management (CRM) applications were earlier prerogative to only big organization. It used to take several months and required huge investments. But today the entire enable infrastructure and applications are provided to you," said Nitin Khanapurkar, Partner, Management Consulting, KPMG India.

The stock of Bajaj Finance has been amongst the best performers in the lending space so far this year, giving returns of 54% compared with the 20% returns of the CNX Finance Index. Despite the sharp rise, its valuations are still attractive compared with its peers. And given the strong performance of its business and its continued focus on lending to the SME (small and medium enterprise) sector, there is still ample room for further appreciation.

Public sector Vijaya Bank has introduced online registration of application and tracking to facilitate speedy clearance of projects under micro and small enterprises. “Through this we have achieved faster processing of MSE applications. We are also encouraging anybody approaching us to opt for online filing of their application and also upload certain document for easier and faster transactions,” said Ms Shubhalakshmi Panse, Executive Director, Vijaya Bank. The bank also initiated regular ‘MSME Melas’ to push to get larger share of MSE disbursal of loan.

IT giant HP recently launched new solutions and services to help small and medium enterprises (SMEs) build their technology infrastructure to cater to the rising mobile workforce. The trend to use devices to access email and other business data requires SMEs to prepare their infrastructure to support increased mobility. Apart from access devices like routers and port switches, business protection solutions like servers, the offerings also include training programmes that enable resource challenged SMEs to simplify IT while enhancing collaboration in an increasingly mobile world.

The Small Industries Development Bank of India (SIDBI) plans to raise an additional Rs 17,000 crore from different lines of credit this year as part of its attempt to reposition itself in the MSME (Micro, Small and Medium Enterprises) sector. It will also focus on ‘factoring’ business and four niche areas it has identified to create an eco-system for the requirement of this sector. The apex financial institution will raise this money from budgetary sources, international and multilateral partners and market borrowings, Mr N. K. Maini, Deputy Managing Director, told newspersons recently.

In effort to promote 'green economy', Bureau of Energy Efficiency (BEE) has signed an agreement with European Union to work towards reducing carbon emission by about 70,000 tonnes in 500 micro and small foundries in Punjab, Rajasthan and West Bengal. Funded by EU, the project will be implemented by a conglomeration of the Foundation for MSME Clusters (FMC), UNIDO, SIDBI, Indian Institute for Corporate Affairs (IICA), GIZ India, and GRI, Netherlands, within next three and half years.

The economic slowdown has hit the small and medium enterprises (SMEs) the hardest. Burdened by high interest rates, elongation of receivable cycles and lack of working capital is forcing several SMEs to down their shutters. The promoter of a dairy food products company told the Indian Express that he had to shut his operations in February after 14 months in the business because of the bank’s delay in funding working capital.

Apex body for credit to Micro Small and Medium Enterprises (MSME) in the country, Small Industries Development Bank of India (SIDBI) has targeted 24% credit growth in Gujarat for financial year 2012-13, officials said. “Our new loan portfolio in the April – June quarter is at Rs222 crore. We target to disburse close to Rs1, 500 crore during the year. We are looking at 24% credit growth to MSME during the year,” regional manager of SIDBI, KC Bhanoo said. Total outstanding loan portfolio for the bank at the end of March 2012 stood at Rs1, 280 crore.

The Micro, Small and Medium Enterprise (MSME) Development Advisory Board put forward some crucial recommendations in a report recently, ahead of the Vibrant Gujarat Global Investor Summit (VGGIS) scheduled for January 2013. The MSME Advisory Board, an apex authority in charge of MSME development in Gujarat consisting of industry representatives, sector experts and government officials, put forward recommendations primarily on the state’s six major MSME sectors.

The Union ministry of micro, small and medium enterprises is planning to fashion an entrepreneurship policy to support entrepreneurial activities in the MSME sector in India. The main purpose of the policy will be to ensure and identify areas of development in the MSME sector. “Currently, the policy is at the formulation stage and it may come into place in a few months,” said, C K Mishra, joint secretary, Union ministry of MSME.

Madras Management Association (MMA) launched its Tiruchi chapter recently, promising to guide small and medium enterprise (SME) entrepreneurs in the region. Coinciding with the launch, a conclave on ‘Empowering Growth of SMEs – The Way Forward’ aimed at equipping proprietors with a competitive spirit was held, in collaboration with Konrad-Adenauer-Stiftung, a German political foundation working for India’s integration with the global economy, and the Indian Institute of Management–Tiruchi (IIM-T). The Ministry of Micro, Small and Medium Enterprises (MSME) is against tweaking or diluting Foreign Direct Investment guidelines in single-brand retail without its nod. Incidentally, applicants such as the Swedish furniture and home accessories retail giant IKEA have expressed reservations over the norm that companies with over 51 per cent FDI should source at least 30 per cent from small industries in India.

The count down for the second Indian Grand Prix has begun! Vodafone India, one of India's leading telecommunications service providers, recently commenced its activation to the second season of the motor racing event in India - Vodafone Drive into the Big League. It extends an opportunity to Small and Medium Enterprises (SME's) to get their logo placed on the Vodafone McLaren Mercedes cars that will race at the second Indian Grand Prix to be held in Delhi from October 26-28, 2012.

The Karnataka Vikas Grameena Bank (KVGB) has prioritised the growth of micro, small and medium enterprises (MSME), and is planning to disburse Rs. 800 crore to the MSME sector this fiscal year, said KVGB chairman C. Sambasiva Reddy. He was speaking after inaugurating an MSME loan Mela recently.

Canara Bank entered into a MoU with credit rating agency Crisil to rate existing and prospective customers of the bank under micro, small and medium enterprise (MSME) sector until March, 2015. Under the MoU, the rating fee is being subsidised for small enterprises (including micro enterprises) registered with NSIC with special discount to such clients of the bank.

|

|

|

|

|

The FISME Factor is impressive and informative, say readers

Read what readers have to say on this newsletter and various other issues.

|

|

|

There are business opportunities available for Indian companies in Canada. The interested candidates can check details.

|

|

|

During the period July 1, 2012 to July 15, 2012 a total of 4 new MSMEs became members of FISME.

|

|

|

A delegation of FISME led by President Shri V.K. Agarwal met Shri Vilasrao Deshmukh, Hon’ble Minister of Science and Technology and also holding additional charge of Ministry of MSME.

Shri Deshmukh emphasized the need to augment manufacturing as it was essential for creating more jobs. He said that MSMEs are a priority for the Government and he promised his full support to them. He also agreed to preside over FISME’s flagship regional event - the India MSME Summit (Western Region) in Mumbai in September this year.

A delegation of FISME led by President Shri V.K. Agarwal met Shri Vilasrao Deshmukh, Hon’ble Minister of Science and Technology and also holding additional charge of Ministry of MSME.

Shri Deshmukh emphasized the need to augment manufacturing as it was essential for creating more jobs. He said that MSMEs are a priority for the Government and he promised his full support to them. He also agreed to preside over FISME’s flagship regional event - the India MSME Summit (Western Region) in Mumbai in September this year.

With the demand for redefining Indian MSMEs gaining ground among various sections of the Indian MSME fraternity, FISME organised a Roundtable on “Revisiting MSME Definition” in New Delhi on July 16, 2012. The Roundtable was attended by, among others, Mr N.K. Maini, DMD, SIDBI, Dr Dinesh Awasthi, Director, Entrepreneurship Development Institute, Dr J.S. Juneja, Chairman, MSME Task Force (PHDCCI), and several representatives of industry bodies and banks. The Roundtable produced a rich exchange of views and ideas and FISME would soon collate the various views presented for further discussion before finalising its recommendations to the government on this subject.

With the demand for redefining Indian MSMEs gaining ground among various sections of the Indian MSME fraternity, FISME organised a Roundtable on “Revisiting MSME Definition” in New Delhi on July 16, 2012. The Roundtable was attended by, among others, Mr N.K. Maini, DMD, SIDBI, Dr Dinesh Awasthi, Director, Entrepreneurship Development Institute, Dr J.S. Juneja, Chairman, MSME Task Force (PHDCCI), and several representatives of industry bodies and banks. The Roundtable produced a rich exchange of views and ideas and FISME would soon collate the various views presented for further discussion before finalising its recommendations to the government on this subject.

FISME held its Annual General Meeting in New Delhi on July 16. The participants reviewed the Draft Annual Activity Report and deliberated on the focus areas to be taken up in the current year.

FISME held its Annual General Meeting in New Delhi on July 16. The participants reviewed the Draft Annual Activity Report and deliberated on the focus areas to be taken up in the current year.  For the latest news on the MSME sector in India and elsewhere in the world just visit the FISME website (www.fisme.org.in). It now offers a 24X7 newsfeed covering all MSME-related news across the world. Just log in and check out.

For the latest news on the MSME sector in India and elsewhere in the world just visit the FISME website (www.fisme.org.in). It now offers a 24X7 newsfeed covering all MSME-related news across the world. Just log in and check out. The website of the Intellectual Property Facilitation Centre of FISME now offers a 24X7 newsfeed on Intellectual Property Rights news across the world. To the best of our knowledge, this is the only Indian website which offers a one-stop shop for all IPR news updated on a real-time basis. Just login to the website and check out.

The website of the Intellectual Property Facilitation Centre of FISME now offers a 24X7 newsfeed on Intellectual Property Rights news across the world. To the best of our knowledge, this is the only Indian website which offers a one-stop shop for all IPR news updated on a real-time basis. Just login to the website and check out.

Factory output grew 2.4 per cent in May, much lower than the growth of 6.2 per cent in the same month last year. The silver lining was that the latest index of industrial production (IIP) growth performance was better than the revised (-) 0.9 per cent for April and (-) 3.2 per cent level of March. The Central Statistics Office had earlier pegged the April industrial growth at a near-zero level of 0.1 per cent.

Factory output grew 2.4 per cent in May, much lower than the growth of 6.2 per cent in the same month last year. The silver lining was that the latest index of industrial production (IIP) growth performance was better than the revised (-) 0.9 per cent for April and (-) 3.2 per cent level of March. The Central Statistics Office had earlier pegged the April industrial growth at a near-zero level of 0.1 per cent. India's exports fell sharply for the second consecutive month in June due to weak demands in North America and European countries, a senior government official said recently. Exports dropped by 5.45 percent to $25.07 billion in June, while imports fell by 13.46 percent to $35.37 billion, leaving a trade deficit of $10.3 billion, Director General of Foreign Trade Anup Pujari told reporters.

India's exports fell sharply for the second consecutive month in June due to weak demands in North America and European countries, a senior government official said recently. Exports dropped by 5.45 percent to $25.07 billion in June, while imports fell by 13.46 percent to $35.37 billion, leaving a trade deficit of $10.3 billion, Director General of Foreign Trade Anup Pujari told reporters. The Small and Medium Enterprises (SMEs) need 'money and credit' that can enable them to invest in new products, new technologies and new markets, said Arun Maira, Member of Planning Commission recently. "To invest in something new, they (SMEs) need money and credit to do so. On the money side, there are two things. One is the SME exchange, which enables them to get small amount of money. The other is the credit growth from the banking sector to the SMEs that enable companies to invest in new products, new technology and new markets," he said on the side-lines of a launch of Millennium Alliance: India-US Innovation Partnership for Global Development.

The Small and Medium Enterprises (SMEs) need 'money and credit' that can enable them to invest in new products, new technologies and new markets, said Arun Maira, Member of Planning Commission recently. "To invest in something new, they (SMEs) need money and credit to do so. On the money side, there are two things. One is the SME exchange, which enables them to get small amount of money. The other is the credit growth from the banking sector to the SMEs that enable companies to invest in new products, new technology and new markets," he said on the side-lines of a launch of Millennium Alliance: India-US Innovation Partnership for Global Development.

Indian Small and Medium Enterprises (SMEs) have started taking advantage of the cloud services but they are facing several challenges when it comes to fully capitalizing on the economic benefits of the cloud, said the industry experts. "The use of cloud computing has just started. For example, the Customer Relationship Management (CRM) applications were earlier prerogative to only big organization. It used to take several months and required huge investments. But today the entire enable infrastructure and applications are provided to you," said Nitin Khanapurkar, Partner, Management Consulting, KPMG India.

Indian Small and Medium Enterprises (SMEs) have started taking advantage of the cloud services but they are facing several challenges when it comes to fully capitalizing on the economic benefits of the cloud, said the industry experts. "The use of cloud computing has just started. For example, the Customer Relationship Management (CRM) applications were earlier prerogative to only big organization. It used to take several months and required huge investments. But today the entire enable infrastructure and applications are provided to you," said Nitin Khanapurkar, Partner, Management Consulting, KPMG India.

IT giant HP recently launched new solutions and services to help small and medium enterprises (SMEs) build their technology infrastructure to cater to the rising mobile workforce. The trend to use devices to access email and other business data requires SMEs to prepare their infrastructure to support increased mobility. Apart from access devices like routers and port switches, business protection solutions like servers, the offerings also include training programmes that enable resource challenged SMEs to simplify IT while enhancing collaboration in an increasingly mobile world.

IT giant HP recently launched new solutions and services to help small and medium enterprises (SMEs) build their technology infrastructure to cater to the rising mobile workforce. The trend to use devices to access email and other business data requires SMEs to prepare their infrastructure to support increased mobility. Apart from access devices like routers and port switches, business protection solutions like servers, the offerings also include training programmes that enable resource challenged SMEs to simplify IT while enhancing collaboration in an increasingly mobile world.

Canara Bank entered into a MoU with credit rating agency Crisil to rate existing and prospective customers of the bank under micro, small and medium enterprise (MSME) sector until March, 2015. Under the MoU, the rating fee is being subsidised for small enterprises (including micro enterprises) registered with NSIC with special discount to such clients of the bank.

Canara Bank entered into a MoU with credit rating agency Crisil to rate existing and prospective customers of the bank under micro, small and medium enterprise (MSME) sector until March, 2015. Under the MoU, the rating fee is being subsidised for small enterprises (including micro enterprises) registered with NSIC with special discount to such clients of the bank.

A survey conducted by SMEinfo, the newly launched online portal dedicated to supporting the growing SME sector in the UAE, showed 45 per cent of business owners in the country believe expansion will be their biggest challenge in the next three years. Conducted early this year, the survey asked more than 300 leading business owners what they thought were the most significant business challenges they expected to face until 2015.

A survey conducted by SMEinfo, the newly launched online portal dedicated to supporting the growing SME sector in the UAE, showed 45 per cent of business owners in the country believe expansion will be their biggest challenge in the next three years. Conducted early this year, the survey asked more than 300 leading business owners what they thought were the most significant business challenges they expected to face until 2015.