| |

|

|

|

|

| President's Message |

Last fortnight witnessed a flurry of initiatives by Central Government to revive or to give impetus to economy. The most important step being the sharp reduction in Corporate tax. More resources in the hands of companies will help them channelise investment in areas where it is needed. However, this is also a fact that over 97% of MSMEs being proprietorship and partnership firms, the benefit will be limited to only a few entities in MSME family. What we hear from our constituents is there is slackening of demand in market. This is one important reason for slow growth. A reduction in personal Income tax could have done wonders. It could have left more money in the hands of public at large and created demand across the board during the festive season. Let’s hope there some good news for personal income tax payers too. Another announcement the Finance Minister made is of huge importance. According to which banks have been told not to declare any stressed loan account of MSMEs a non-performing asset until March 2020. The MSME sector has been undergoing a stressful phase due to liquidity crunch. Their payments are stuck with corporate sector and banks have become reluctant to come to their rescue after crash in NBFC market. The situation has threated large number of otherwise healthy MSMEs to the brink of being classified as NPAs. It would a relied for MSMEs. Government is discussing more steps to prime pump economy in consultation with stakeholders. Let’s hope for the best.

"

Animesh Saxena, President, FISME

|

|

| Vol VII, Issue 188: Oct 1, 2019 |

|

|

|

|

| Business Banter: Lessons from Entrepreneurs |

Every entrepreneur’s journey is exciting and unique. It is your passion and conviction in your idea that keeps you going. The fact that being an entrepreneur allows your decisions to have real world impact and face real time consequences for your actions – whether positive or negative – is what challenged and motivated me. Another upside is tremendous room for self-growth during the course of your journey, from time management and interpersonal communication skills, self-confidence and most importantly – fulfillment.

|

| Writing on the Wall |

The positive impact will be most perceived in the FMCG, capital goods and steel sectors

The Centre’s move on Friday to slash corporate tax rate ranks as another landmark reform step, after the implementation of GST and the bankruptcy code. It effectively corrects the Budget proposal, which restricted the corporate tax cut to companies below an annual turnover of ₹400 crore, by expanding it to all domestic companies — and goes a step or two further.The tax rate for all companies has been reduced from 30 per cent earlier to 22 per cent now; after including cess and surcharge...

|

| Media Monitor |

Macro Metre

|

The Directorate General of Foreign Trade (DGFT) has disallowed issue of advance authorisation where items of export are gold medallions and coins or any jewellery/articles manufactured by fully mechanised process.

In a notification, DGFT said “Advance Authorisation shall not be issued where items of export are gold medallions and coins or any jewellery/articles manufactured by fully mechanised process.”

|

The Directorate General of Foreign Trade (DGFT) has said in a notification that import of electronic cigarettes (E-Cigarettes) or even its parts or components is now prohibited.

The DGFT said that Import of e-cigarettes or any parts such or components thereof such as refill pods, atomisers, cartridges etc including all forms of Electronic Nicotine Delivery Systems, Heat not Burn Products, e-Hookah and the like devices by whatever name and shape, size or form it may have, but does not include any product licensed under the Drug and Cosmetics Act, 1940…is prohibited in accordance with the Prohibition of Electronic Cigarettes (Production, Manufacture, Import, Exports, Transport, Sale, Distribution, Storage and Advertisement) Ordinance, 2019.

|

The government has asked banks not to declare any stressed loan account of MSMEs as Non Performing Assets (NPA) till March 2020.

‘’There already exists a circular from the Reserve Bank that provides for stressed loan accounts of MSMEs not being declared non-performing assets (NPAs),’’ Finance Minister reminded at a press conference on Thursday after meeting PSU bank heads. Following which she said that banks have been asked to follow that circular and not declare any stressed MSME loan as NPA till March 2020 and look at recasting their debt.

|

|

|

The Doing Business Report 2020, commissioned by the World Bank has ranked India as one of the top 20 improvers. As per the World Bank report, the list includes 20 economies which have improved the most on ease of doing business score.

With India improving most in four areas: Obtaining construction permits, starting a business, the ease of importing and exporting and resolving insolvency, India continues to be on 77th position in terms of ease of doing business.

|

The Ministry of Micro, Small and Medium Enterprises (MSME) is seriously considering to introduce a policy to check delayed payments to MSMEs from major industries, public entities, state and central governments, Nitin Gadkari, Union Minister for Road, Transport, Highways and MSMEs said.

''MSMEs have been facing problems in receiving timely payment for the supplies they offered to major industries, public entitites and government agencies.

|

To boost Micro, Small and Medium Enterprise (MSME) sector in India, the central government is cosidering to contribute 10% of funds to the small companies looking to raise equity capital through capital markets, Union MSME Minister Nitin Gadkari said on Tuesday.

“The government will contribute 10 per cent to the companies who enroll themselves in the capital market and stock exchange to raise equity,'' Gadkari said at 16th Global SME Summit in Delhi.

|

Finance Minister Nirmala Sitharaman on Friday said the government has slashed the effective corporate tax from 30 per cent to 25.17 per cent, inclusive of all cess and surcharges for domestic companies.

Sitharaman said the total revenue forgone on account of today's measures would be Rs 1.45 trillion per year.

Here are the highlights:

--- (1) In order to promote growth and investment, a new provision has been inserted in the Income-tax Act with effect from FY 2019-20 which allows any domestic company an option to pay income-tax at the rate of 22% subject to condition that they will not avail any exemption/incentive. The effective tax rate for these companies shall be 25.17% inclusive of surcharge & cess. Also, such companies shall not be required to pay Minimum Alternate Tax.

|

| State Scan |

Goa

The Goa government has banned single-use plastic in its offices from October 2, 2019.

In a circular issued, Under Secretary of the general administration department, Shripad Arlekar said, "The Government of Goa has decided to ban the usage of single-use plastic water bottles, glasses, plates, etc. in the government offices, canteens, meetings and functions from October 2, 2019 onwards." The circular issued has asked all government officers to ensure that the use of plastic water bottles, glasses, plates shall be discontinued and instead items which are eco-friendly and reusable to provide water and other items in the offices, meetings functions are to be used.

Odisha

In a bid to bring investments in the state, Odisha Chief Minister Naveen Patnaik has invited Korean industries to invest in Odisha.

Welcoming the ambassador of the Republic of Korea, Shin Bong-kil, and a nine-member business delegation at Lok Seva Bhawan here, the CM said there were significant opportunities for both Korea and Odisha to strengthen trade, investment and tourism ties.

Assam

To set up a tool room and training centre at Quality Control building at Borguri in Tinsukia under the special scheme ‘Promotion of MSME in NE Region and Sikkim’, a Memorandum of Understanding (MoU) was signed with the Tool Room & Training Centre, Guwahati.

Commissioner and secretary of Assam’s Industries and Commerce Department, S S Meenakshi Sundaram signed the MoU with the project manager, Kajal Kumar Saha, Tool Room & Training Centre, Guwahati. The Tool Room will be set up under the special scheme ‘Promotion of MSME in NE Region and Sikkim’.

The MoU was signed in the presence of state industries and commerce minister, Chandra Mohan Patowary.

Punjab

The Punjab government is all set to set up Micro, Small and Medium Enterprise (MSME) facilitation centers in every district of the state.

While addressing the CII 7th Regional SME Summit, Punjab Additional Chief Secretary (Industries and commerce) Vinni Mahajan on Monday said that Punjab will be the first state in the country to take such a step, if all goes well.

‘’These centers would help would help policymakers to gather feedback from various industries and address grievances’’ she said.

She also urged MSMEs to make use of the Make in Punjab platform.

|

| World Watch |

France

France has shown a keen interest in having long term tie-up with Andhra Pradesh in infrastructure development, automobiles and renewable energy. A delegation of 39 heads of French companies called upon Chief Minister YS Jagan Mohan Reddy at his camp office in Tadepalli on Thursday and held discussions on matters of mutual interest.

The French team, which was on two - day visit to the state, stressed the need for long term and sustainable partnerships with the state. The MEDEF (Federation of France Entrepreneurs) led by Geoffrey Roux de Bezieux, said, Andhra Pradesh is the focal point of partnerships and collaborations of the MEDEF.

Thailand

GlobalLinker, a digitization platform for SMEs, today signed a Memorandum of Understanding (MoU) with Thailand India Business Council (TIBC) under which a platform called ‘Thailand India GlobalLinker’ will be created to facilitate digital business networking between SMEs from India and Thailand.

The platform will also connect SMEs to all the GlobalLinker members across Asia. A new corridor between India and Thailand will be created to connect SMEs, to enable them to strike new trade deals. It is estimated that this initiative will bring over 40,000 SMEs from Thailand & India onto the GlobalLinker platform, according to a press release.

United States of Emirates

Union Minister of Commerce & Industry, Piyush Goyal will visit UAE from September 21 to 22, 2019 for the meeting of the 7th India-UAE High Level Task Force on Investment (HLTFI).

The meeting will see wide-ranging discussions on priority sectors of engagement for channelling investments between the two countries. The HLTFI was established in May 2012 to address issues associated with existing investments between India and UAE.

It is an institutional arrangement to discuss ways for increasing investments and deliberating on opportunities for cooperation and investment in both the countries.

|

|

|

|

|

|

FISME’s official Twitter handle @fisme |

|

KNN India’s official Twitter handle @knnindia |

|

|

|

| Other Events |

SolarRoofs India Bangalore

Date: 10 Oct 2019

Venue: The Lalit Ashok Bangalore, Bengaluru

See Details

Glasspex India

Date: 10-12 Oct 2019

Venue: Bombay Exhibition Centre (BEC), Mumbai

See Details

TechSparks

Date: 11-12 Oct 2019

Venue: Vivanta by Taj - Yeshwantpur, Bangalore, Bengaluru

See Details

India Food Tech Expo

Date: 11-13 Oct 2019

Venue: Chennai Trade Centre, Chennai

See Details

Faridabad Trade Fair

Date: 27 Sep-13 Oct 2019

Venue: Huda ground, Faridabad

See Details

DAIRY INDUSTRY EXPO

Date: 11-13 Oct 2019

Venue: Auto Cluster Exhibition Center, Pune

See Details

India Carpet Expo

|

| Your Views |

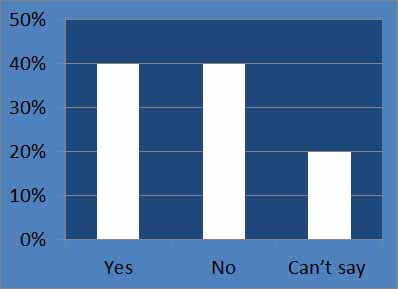

Do you think that the measures announced by the finance minister to stabilise the Indian economy will be beneficial for Indian MSME?

According to FISME factor 40% of MSMEs think that the measures announced by the finance minister to stabilise the Indian economy will be beneficial for Indian MSME, 40% think it will not while 20% can’t say.

|

| Knowledge Store |

HR Heuristics

Strategic rewards and recognition best practices

Luminous India realised that a strong rewards and recognition strategy was necessary to build a culture of innovation amongst its employees. Xoxoday helped design a strategic rewarding campaign, which positively reinforced the innovation efforts of the employees at Luminous.

|

Finance Fundamentals

6 Reasons Why Business Owners and SMEs should Approach FinTech Lenders for their Fund Requirement

Fintech Lenders are the financial institutions that offer business loans to entrepreneurs with minimal documentation and process time with maximum loan amounts and flexibilities. There has been a giant leap in the growth of Fintech companies in India between 2015 and 2018. Mumbai is the first place with many Fintech startups, Bangalore, Delhi, and Hyderabad follows.

|

|

Marketing Mantras

The 6 basics of startup branding that can help you get ahead of competition

The startup ecosystem is a highly competitive one. Though we have grown accustomed to the notion that a great idea that’s perfectly executed, is all it takes to reel in large investments and become a major player, this is no longer the case.

|

|

Policy Polemic

Telangana MSMEs running in residential areas deprived of subsidies available to firms in industrial parks

Various Micro, Small and Medium Enterprises (MSMEs) units in Telangana running in residential areas do not get subsidies that are available to companies set up in industrial parks, said Kapra Small Industries Association.

|

|

SME Special

How agritech startup Harabaag organises the post-harvest supply chain using micro-level crop data

Mumbai-based Harabaag claims to have captured crop data from nearly 120,000 farmers in two years. The bootstrapped startup is doubling its revenue month-on-month, and looks to expand into the cow belt.

|

|

Success Story

From Rs 7 lakh to Rs 3 Cr in revenue, this Ludhiana venture sells customised apparel to Google, Amazon, and UberEats

Launched in 2014, Ludhiana startup QuadB is a bootstrapped B2B customised apparel brand, which has expanded operations to 100 cities, 20 states, and five countries. The founders are targeting revenue of Rs 25 crore in 2020.

|

Stockpile

The National Statistical Office (NSO), Ministry of Statistics and Programme Implementation Ministry has been bringing out the employment related statistics in the formal sector covering the period September 2017 onwards

|

Quotable Quotes

“

Your work is going to fill a large part of your life, and the only way to be truly satisfied is to do what you believe is great work. And the only way to do great work is to love what you do.

”

– - Steve Jobs, Apple Inc. co-founder, chairman and CEO

|

| Country Chronicles |

|

FISME regularly receives monthly reports on the economies of various countries from their missions in India. These reports provide information on key economic parameters, trade related information and all news relevant for importers and exporters. In this edition you can take a look at reports on:

|

| Reader Reactions |

Write and Win prize!

Write your comments on the FISME Factor. Share your views and suggestions on MSME issues. Win prize! The best mail will get a special book every fortnight.

send mail to: newsletter@fisme.org.in

|

| Editorial Team: |

Hon. Editor: Anil Bhardwaj

Asstt. Editor: Kalpana Sharma

Types setting & websdesigning: Sanjay Sachan

Video & Photography: Subhan Khan

|

|

|

|

You are receiving this Newsletter because you are included in our mailing list of recipients who are involved or interested in FISME or Indian MSMEs. You are welcome to partly or fully reproduce and disseminate the contents of this publication provided that you acknowledge the source.

To subscribe/unsubscribe to this Newsletter

click subscribe or unsubscribe

This Newsletter is edited by the FISME Secretariat. We welcome contributions as well as comments and suggestions. Please write to newsletter@fisme.org.in |

|

|

|

Bangalore

57/5, Family YMCA Building,

Millers Road, Benson Town,

Bangalore - 560046

Tel: +91-80-23543589

Email: bangalore@fisme.org.in

|

Hyderabad

H. No. 6-3-569 / 1/2/4

2nd floor, Rockdale Compound, Somajiguda

Hyderabad – 500082

Tel: +91- 40- 23322117 Fax: +91 -40- 23312116

Email: hyderabad@fisme.org.in

|

|

|

| |

Jhandewalan

Tel: +91- 11- 4364 2013

Email: chamber.jw@fisme.org.in

|

Mahipalpur

Tel: +91 -11- 46035866

Email: chamber.mpur@fisme.org.in

|

Kalkaji

Tel: +91 -11- 4106 8644

Email: kalkaji@fisme.org.in

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|