| |

|

|

|

|

| President's Message |

Whole of April has gone under locked down. India seems to have fared better in terms of managing to keep the mortality rate low among its peers. But the economic mayhem it is set to unleash is scary. The economic relief package has got delayed inordinately. It has created confusion among eth employers as well as employees. Employers are not sure whether to keep the staff without work and how long. Employees- especially migratory labour, are confused how long to stay put in industrial clusters without pay, shelter and life support. So even when factories are allowed to open in green and orange zones and a wide variety of them in red zones too, employers are hesitating to open factories and workers are returning home! This will further deepen the crisis. Industry associations including FISME has already shared candidly as to what is needed to be done. It’s high time that Government be honest with stakeholders on what they are thinking and planning so that industry also act accordingly. Secondly, the industrial zones are being barricaded by adjoining states making mockery of opening up. How could you do business in NCR without crisscrossing Delhi-Haryana-West UP. The state of confusion is poison to business and that must end sooner.

"

Animesh Saxena, President, FISME

|

|

| Vol VIII, Issue 202: May 1, 2020 |

|

|

|

|

| Business Banter: Lessons from Entrepreneurs |

“The world economy will go into recession this year with a predicted loss of global income in trillions of dollars.” The Asian Development Bank (ADB) projects India's gross domestic product (GDP) will slow to 4 per cent in the fiscal year 2020 ending on March 31, 2021 due to a weak global environment and continued efforts to contain the novel coronavirus (COVID-19) outbreak in the country.

|

| Writing on the Wall |

A strategy that focusses on intensifying testing and possibly curbs on the vulnerable population, while allowing the rest to resume economic activity with the necessary precautions, must be workerd out The Centre’s decision to further extend the lockdown by two weeks may or may not flatten the Covid-19 infection curve, but will certainly decimate India’s growth curve. In a sign of things to come, India’s eight core sector industries, which account for a weight of 40 per cent in the Index ...

|

| Media Monitor |

Macro Metre

|

The Employees Provident Fund Organisation (EPFO) has allowed companies to separately file the Electronic Challan cum Return (ECR) and the payment of statutory contribution.

The EPFO observed that in the current scenario the businesses and enterprises are not able to function normally and are facing liquidity or cash crunch to pay their statutory dues even though they are retaining the employees on their rolls. "With a view to further ease the compliance procedure under EPF & MP Act, 1952, the creation and filing of monthly electronic-challan cum return (ECR) is separated from payment of the statutory contributions reported in the ECR," EPFO said in a statement on Thursday.

|

The Directorate General of Foreign Trade (DGFT) has granted the extension in the import validity period and the export obligation period for existing Advance Authorizations (AAs)/DFIA expiring from February to July 20.

The notification was issued addressing all the Regional Authorities of DGFT and Exporters and Member of Trade. As per the notification, the Regional Authorities of DGFT and Member of Trade are supposed to follow the procedure prescribed in the notification.

Firstly, Automatic Extension of Import Validity period and EO period by 6 months for AAs under Hand Book of Procedures (HBP) Para 4.41(e) and Para 4.42(h) where no revalidation/EO period extension has been granted till date.

|

The government is planning to set up Rs 1 lakh crore fund to clear outstanding dues of Micro Small and Medium Enterprises (MSMEs) owed by the central and state government undertakings as well as major industries.

"We have decided to set up a fund of Rs 1 trillion. We will ensure this fund with the government paying the premium. We will come up with a formula for sharing of the interest burden between the paying entity and payment-receiving entity and banks against this fund, for the payments due to MSMEs which are stuck with the PSUs, centre and state governments and major industries," Gadkari said while speaking at an ASSOCHAM webinar.

|

India has put restrictions on import of pulses by reducing the import quota and laying down a procedure for its inbound shipment.

The Directorate General of Foreign T seerade (DGFT) has said in a trade notice that the import quota for green peas has been to 75,000 tonne for 2020-21. Last year, the quota for import of yellow and green peas was 1.5 lakh tonne. There is no quota for import of yellow peas for the current fiscal. DGFT notification said the import would be allowed only to the millers/refiners. The ministry has invited online applications from millers and refiners who have their own units.

|

|

|

A control room set up by the Department for Promotion of Industry and Internal Trade (DPIIT) to monitor issues of trade and industry has resolved as many as 1,739 matters as on 28 April.

Out of the total number of 1,962 queries registered till April 28, as many as 1,739 have been resolved/settled. 223 are currently under resolution. “Out of 1,962 queries registered, more than 1,000 queries were received from five states/UTs -- Delhi, Maharashtra, Uttar Pradesh, Haryana and Gujarat," the commerce and industry ministry said in a statement on Thursday.

|

The Supreme Court (SC) on Thursday refused to intervene and stay the order of the Ministry of Home Affairs' (MHA) order directing Micro Small and Medium Enterprises (MSMEs) to pay full wages.

Reportedly, the apex court was hearing a plea by Mumbai-based Twin City Industrial Employers Association which had sought a stay MHA order. The petitioners had argued that amid lockdown when businesses have been halted following which there is zero revenue, how it is possible to pay full wages to workers. A bench of the apex court headed by Justice Ramana was unmoved by the petitions. Refusing to intervene, he observed that despite threats of action being issued, no one had been prosecuted under the MHA order or under the Disaster Management Act.

|

Small Industries Development Bank of India (SIDBI) has said it would provide funds to Micro, Small and Medium Enterprises (MSMEs) via banks, Non-Banking Financial Companies (NBFCs) and other finance institutions.

"We are ously working towards helping MSMEs survive the crisis created due to the COVID-19 pandemic. Keeping the current situation in mind, we were provided a special liquidity window of Rs 15,000 crore by the Reserve Bank of India (RBI) to enable MSMEs to tide over their liquidity crunch. The funds will be channelized to MSMEs through eligible banks, NBFCs and MFIs," Sidbi's chairman and managing director Mohammad Mustafa said in a release.

|

Ministry of Micro Small and Medium Enterprises (MSMEs) has issued a Standard Operating Procedure (SOP) for the MSME units.

The objectives of the SOPs are to prevent transmission of COVID-19 amongst the employees and workers of MSMEs while ensuring continuity of businesses so that livelihoods are not impacted. The ministry has said that all areas in the premises including Entrance Gate of building, office; Cafeteria and canteens; Meeting rooms, open areas available; verandah/ entrance gate of site, rooms in the building etc; Equipment and lifts; Washroom, toilet, sink, water points etc; Walls/ all other surfaces shall be disinfected completely.

|

| State Scan |

Haryana

In order to help Micro Small and Medium Enterprises (MSMEs) in retaining their employees amid COVID-19 crisis, Haryana government has formulated "Haryana MSME revival Interest Benefit Scheme".

A decision to this effect was taken in the Haryana Cabinet which met under the Chairmanship of Chief Minister, Manohar Lal Khattar here on Thursday. Under this scheme, all MSME units working in Haryana as on or before March 15, 2020, will be eligible for 100 percent interest benefit on loans availed for payment of the wages of employees or other expenses up to a maximum of Rs 20,000 per employee for a period of six months, an official statement said.

Andhra Pradesh

The Andhra Pradesh (AP) government has decided to clear all the pending incentives for the Micro, Small and Medium Enterprises (MSMEs) due since 2014 amounting to Rs 905 crore.

''The Rs 905 crore of pending incentives for the MSME sector will be paid in two instalments in May and June. The AP government has decided to waive the Rs 188 crore of power demand charges for three months of April, May and June,'' the chief minister’s office said in a statement. Further in a bid to give more relief to COID-19 affetced MSMEs, Chief minister YS Jagan Mohan Reddy has also order to extend the sector Rs 200 crore of low-interest working capital.

Rajasthan

Rajasthan government has issued an advisory for Micro Small and Medium Enterprises (MSMEs) and other commercial establishments in the state to pay salaries of workers or labourers for the month of April.

The advisory issued by MSME and industries department said that all the payments should be made through various online platforms. ''All the industrial units and commercial establishment in your respective jurisdiction be advised to transfer wages/salaries to their staff bank accounts either through direct benefit transfer (DBT) or using other online modes for fund transfers such as NEFT, RTGS etc without any deduction for the period their establishments are under closure during the lockdown period in accordance with cited directives issued by government of India,'' said the advisory.

Tamil Nadu

The Khadi and Village Industries Commission (KVIC), an autonomous body under Ministry of MSME, in collaboration with its Khadi Institutions (KIs) in Tamil Nadu purchased cocoons from cocoon farmers in order to help the farmers struggling to sell them during lock down.

The move also aims to ensure continuous supply of Cocoons to the khadi institutions involved in Silk production. Shedding light on the issue Chairman, KVIC, Vinai Saxena said that “Prime Minister Narendra Modi said that farmers are the backbone of the country. Keeping in mind their welfare, these purchases were not as easy as it looks.

|

|

|

|

|

|

FISME’s official Twitter handle @fisme |

|

KNN India’s official Twitter handle @knnindia |

|

|

|

| Your Views |

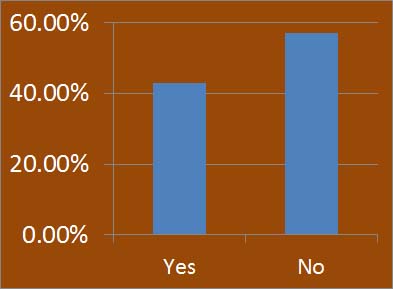

Do you think that government has taken adequate initiatives to revive Indian MSMEs, amid COVID-19 lockdown?

According to FISME factor, amid COVID-19 lockdown 42.9% MSMES think that government has taken adequate initiatives to revive Indian MSMEs while 57.1% don't think so.

|

| Knowledge Store |

HR Heuristics

How performance management may change in the post-Covid era

The Covid-19 virus has been a game changer and a disruptor. It’s unprecedented, and has forced us to relook at the way we live and the way we work.

Going by the same rule, it will also influence the way performance is managed.

|

Finance Fundamentals

5 Ways to Protect Your Business and Personal Credit Scores During a Crisis

Between uncertain cash flow and concern over how to meet financial obligations such as payroll and bills, it's a stressful time to be a small-business owner. Many entrepreneurs are experiencing the same anxieties over unemployment, debt and financial sustainability. Your personal and business credit scores could take a hit if you have to miss payments due to a cash shortfall.

|

|

Marketing Mantras

COVID-19 And the Resulting Shift In Marketing Trends

By now, you must’ve realized the severity of the pandemic that we are going through. Businesses are shutting up shops and economies are crashing, let alone the death tolls. Per this moment, there are 1,600,000-plus confirmed COVID-19 cases worldwide with over 100,000 deaths and it is predicted that European and the US economies could take next three years to cover up for this crisis. My thoughts are with everyone who is personally impacted.

|

|

Policy Polemic

EFCAI suggests FM to directly transfer funds into the accounts of MSMEs

In order to create cash flow in the Micro Small and Medium Enterprises (MSMEs), the Entrepreneurs and Financial Customers Association of India (EFCAI) has suggested Finance Minister Nirmala Sitharaman to directly transfer funds into their accounts.

EFCAI asked Minister to provide exclusive relief packages to MSMEs so that they can make up losses suffered by them due to the COVID-19 lockdown.

|

|

SME Special

This Hyderabad startup has developed an IoT-enabled portable ventilator for coronavirus patients

One of the major problems faced by people suffering from coronavirus infection is respiratory distress. The patients have to be put on a ventilator to help them breathe. Apart from the lack of ventilator infrastructure in India to help the increasing number of coronavirus patients, normal ICU ventilators are expensive and also put the healthcare professionals at risk of contracting the infection.

|

|

Success Story

Chennai startup Garuda Aerospace to combat COVID-19 by using drones to disinfect 26 cities

Before the coronavirus outbreak, drone startups in India had one main concern - regulatory grey areas. Often seen as a security threat, drones were initially used only in the armed forces. But gradually, they percolated into the domain of civilian activity, and were used for industrial applications, imagery, and surveillance.

|

Stockpile

The National Statistical Office (NSO), Ministry of Statistics and Programme Implementation has been bringing out the employment related statistics in the formal sector covering the period September 2017 onwards, using information on the number of subscribers who have subscribed under three major schemes

|

Quotable Quotes

“ It is important to remember, there are no overnight successes. You will need to be dedicated, single-minded, and there is no substitute to hard work.

”

– - Mukesh Ambani - CEO & Chairman of Reliance

|

| Country Chronicles |

|

FISME regularly receives monthly reports on the economies of various countries from their missions in India. These reports provide information on key economic parameters, trade related information and all news relevant for importers and exporters. In this edition you can take a look at reports on:

|

| Reader Reactions |

Write and Win prize!

Write your comments on the FISME Factor. Share your views and suggestions on MSME issues. Win prize! The best mail will get a special book every fortnight.

send mail to: newsletter@fisme.org.in

|

| Editorial Team: |

Hon. Editor: Anil Bhardwaj

Asstt. Editor: Kalpana Sharma

Types setting & websdesigning: Sanjay Sachan

Video & Photography: Subhan Khan

|

|

|

|

You are receiving this Newsletter because you are included in our mailing list of recipients who are involved or interested in FISME or Indian MSMEs. You are welcome to partly or fully reproduce and disseminate the contents of this publication provided that you acknowledge the source.

To subscribe/unsubscribe to this Newsletter

click subscribe or unsubscribe

This Newsletter is edited by the FISME Secretariat. We welcome contributions as well as comments and suggestions. Please write to newsletter@fisme.org.in |

|

|

|

Bangalore

57/5, Family YMCA Building,

Millers Road, Benson Town,

Bangalore - 560046

Tel: +91-80-23543589

Email: bangalore@fisme.org.in

|

Hyderabad

H. No. 6-3-569 / 1/2/4

2nd floor, Rockdale Compound, Somajiguda

Hyderabad – 500082

Tel: +91- 40- 23322117 Fax: +91 -40- 23312116

Email: hyderabad@fisme.org.in

|

|

|

| |

Jhandewalan

Tel: +91- 11- 4364 2013

Email: chamber.jw@fisme.org.in

|

Mahipalpur

Tel: +91 -11- 46035866

Email: chamber.mpur@fisme.org.in

|

Kalkaji

Tel: +91 -11- 4106 8644

Email: kalkaji@fisme.org.in

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|