| |

|

|

|

|

| President's Message |

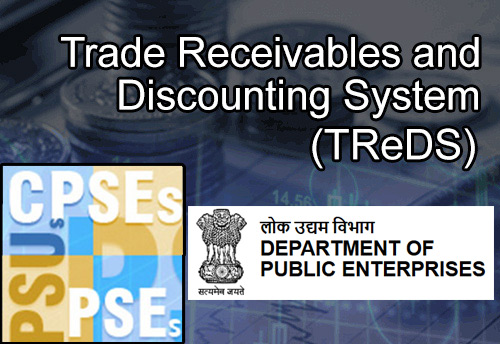

The Union Budget (2020-21) is finally unveiled. The run up to the Budget has been of heightened expectations and not all of them could be met. That is why Sensex shed almost thousand point on the day. So far MSMEs are concerned, the Budget attempted to address three pain points of MSMEs: financing of receivables, need of additional funds while growing and reducing compliance burden among the informal enterprises. Opening doors for NBFCs to finance invoices uploaded by MSMEs at TReDS will give a big boost to these platforms. It was one of the suggestions given by me to the Finance Minister for rapid growth of TReDS platforms. To address the need of additional Working capital needed by fast growing enterprises, a scheme to provide subordinate debt for MSMEs has been proposed in the budget. This subordinate debt to be provided by banks would count as quasi-equity. As it will not be secured debt it has been proposed to be fully guaranteed through the Credit Guarantee Trust for Medium and Small Entrepreneurs (CGTMSE). It would allow MSMEs to raise funds without bringing in additional collateral securities. Raising the statutory tax audit threshold from Rupees one crore to five crore will come as a welcome relief for large number of traders. We feel it is a welcome step but the rider that the enterprises should not have more than 5% of turnover in cash will restrict its uptake. While I appreciate the proposition of extending the restructuring scheme for another one year, I feel there is a need for complete overhaul of the scheme. There have been several sectoral initiatives including for Textiles, electronics, e-vehicle, footwear, furniture among others.

Overall, with emphasis of the Budget on enhancing spending by increasing rural income and reduction in personal income tax and at the same time giving boosting shot through massive investment in infrastructure, the Budget will induce growth without undermining fiscal prudence.

"

Animesh Saxena, President, FISME

|

|

| Vol VII, Issue 196: Feb 1, 2020 |

|

|

|

|

|

| Business Banter: Lessons from Entrepreneurs |

It’s a VUCA (volatility, uncertainty, complexity and ambiguity) world that we live in today. Global megatrends such as geopolitical transitions, dynamic oil pricing, technological advancement, etc. shape industry dynamics, making the future business scenario unpredictable and complex. It is, therefore, crucial to assess these megatrends thoroughly and incorporate them in business strategies.

Regulation changes, for instance, impact in shorter time horizons, while factors like changing demographics show their effect in the longer term. To evaluate trends across time horizons, organisations follow different approaches.

|

| Writing on the Wall |

The Economic Survey released this afternoon has forecast an improvement in India’s economic prospects. The GDP is expected to grow 6-6.5% in 2020-21, as compared to 5% growth forecast for the current year. One of the reasons for optimism is that the Survey believes that a government with a strong mandate has the capacity to deliver expeditiously on economic reforms. There can be no two opinions about the mandate. The challenge, however, is to come up with a coherent strategy..

|

| Media Monitor |

Macro Metre

|

In order to reduce the compliance burden on small retailers, traders, shop keepers who comprise the Medium, Small and Micro Enterprise (MSME) sector, the Union Budget proposed to raise by five times the turnover threshold for audit from the existing Rs.1 crore to Rs. 5 crore.

While presenting the Union Budget 2020-21 in Parliament today, the Union Minister for Finance & Corporate Affairs, Nirmala Sitharaman said that in order to boost less cash economy, the increased limit shall apply only to those businesses which carry out less than 5% of their business transactions in cash.

|

The Department of Public Enterprises (DPE), Ministry of Heavy Industries and Public Enterprises has been mandated to monitor the onboarding of all Central Public Sector Enterprises (CPSEs) on Trade Receivable Discounting System (TreDS) portal and display the details of registration “prominently” on their websites. The CPSEs have also been directed to ensure that their MSE vendors are also registered on TReDS platform.

|

To combat slowdown which has tightly gripped the economy including the micro, small and medium enterprises (MSMEs) of the country, the Ministry of MSME has made two crucial changes in the Credit Guarantee Fund Scheme for Micro and Small Enterprises (CGTMSE). Firstly, the micro and small enterprises (MSEs) seeking collateral free loan under CGTMSE can now take a top up and secondly the collateral free loans under CGTMSE can now be taken for the second time as well by the MSEs which was not the case earlier. There is a high risk perception amongst lenders while giving loans to MSMEs which leads to banks insisting on collateral security.

|

The Input Tax Credit (ITC) on GSTN portal has been blocked in all cases where there are ongoing investigations or even if there is a mere allegation against a taxpayer of credits taken on the basis of bogus bills.

Talking to KNN India, Pankaj Bansal, a Delhi based exporter said, “The government should definitely stop such activities if they are happening but at the same time government should come up with such policy where the ITC claims of genuine exporters should continue.” Bansal, who is also a senior member of Federation of Indian Micro and Small & Medium Enterprises (FISME) said, ''If somebody has done something wrong then definitely their ITC should be stopped. The companies who are claiming ITC on bogus bill, the government should stop their GST ITC but at the same time they should have a policy that the ITC of genuine exporters shouldn't be stopped by the government.''

|

|

|

The Revenue Department has reduced the cash loan acceptance and repayment limit from Rs 20, 000 to Rs 10, 000 in aggregate.

The department has also reduced the limit of all expenses in aggregate to Rs 10, 000 in cash.

The move is likely to impact the micro, small and medium enterprises (MSMEs) as the informal sector entrepreneurs depend heavily on cash loans and expenses in cash.

CBDT has notified Rule 6BBA and amended Rule 6DD to include new payments method as non-cash payments for getting benefits/reliefs under various provisions of the Income Tax Act, 1961.

|

The Central government has issued internal instructions to block Input Tax Credit (ITC) on GSTN portal in all cases where there are ongoing investigations or if there is a mere allegation against a taxpayer of credits taken on the basis of bogus bills.

Input Tax Credit (ITC) means at the time of paying tax on output, you can reduce the tax you have already paid on inputs and pay the balance amount. 'All the Zonal Chief Commissioners have the facility to block/unblock ITC availed in a situation covered under Rule 86A (1) (a) of the CGST Rules, 2017 i.e. against fake invoices or against invoices without receipt of goods or services or both, if such availers of credit are located in their jurisdiction,'' Directorate General of GST Intelligence (DGGI) said in a letter dated 13.01.2020.

|

The Khadi and Village Industries Commission (KVIC) has enhanced the wages for militancy affected women of Jammu and Kashmir who are now engaged into stitching Khadi Rumaals (Handkerchiefs).

This was in line with the suggestions of Union Minister for Micro, Small and Medium Enterprises (MSME) Nitin Gadkari made on December 17, 2019 while launching sale of ‘Khadi Rumal’ being stitched by militancy affected women of Jammu and Kashmir (at Nagrota near Jammu). The Chairman of KVIC VK Saxena has approved the enhancement of wages from Rs. 2 to Rs. 3 per piece with effect from January 1, 2020.

|

| State Scan |

Gujarat

In order to onboard thousands of artisans, weavers and craftsmen and to promote local business, E-commerce giant Flipkart has signed a memorandum of understanding (MoU) with the Gujarat State Handloom and Handicrafts Development Corporation Ltd (GSHHDC).

The MoU was signed in the presence of Gujarat Chief Minister Vijay Ramniklal Rupat an event in Rajkot.

Speaking on the same, GSHHDC Managing Director Mahesh Singh said, ''GSHHDC and Flipkart will work together to enhance business and trade inclusion. Eligible sellers under GSHHDC will receive training and incubation support from Flipkart in the form of onboarding, business insights, dedicated seller support and warehousing.''

Uttar Pradesh

Government e-Marketplace (GeM) and Uttar Pradesh Government will together set up a GeM Organizational Transformation Team (GOTT) Project Management Unit (PMU) in the State, a move which will make it easier for micro, small and medium enterprises (MSMEs) of state to onboard and transact on GeM.

GeM, under the Department of Commerce, Ministry of Commerce & Industry and Government of Uttar Pradesh, signed a Memorandum of Understanding (MoU) to set up a GOTT PMU in the State.

Tamil Nadu

Tamil Nadu Chief Minister Edappadi K Palaniswami-led cabinet has cleared an investment proposals worth Rs 50,000 crore to showcase the state as an attractive investment destination.

During the Cabinet meeting, discussions were also held on single window clearances and the pending projects, ease of doing business and micro, small and medium enterprises (MSME) related agenda to facilitate speedy implementation of projects. The clearances of investment proposals worth Rs 50,000 crore include offering structured package of incentives, based on the employment generation potential of these units.

Kerala

In a bid to enhance Ease of Doing Business (EODB) environment, the Kerala government has modified 'Kerala single window interface for fast and transparent clearance' (KSWIFT) to facilitate immediate clearance for investment proposals up to Rs 10 crore.

Launching the upgraded KSWIFT portal here on Monday, Kerala industries minister E P Jayarajan, said, “The live website will be a boon for entrepreneurs. There are 1,38,000 Micro, Small and Medium Enterprises (MSME) in Kerala and around 52,000 of them were set up after this government came into power.''

|

| World Watch |

Brazil

Indian Industry Association has invited the Brazilian government to be the country partner for “India Food Expo-2020” which will be organized by IIA at Lucknow in November this year.

''The Minister readily agreed to the proposal of President IIA for which formal correspondence will be made soon. Brazilian Minister showed interest to export the raw material for food processing in India by Micro Small and Medium Enterprises (MSME’s) for which they are ready to transfer the technology also if required,'' IIA said in a press release. In a meeting held at Taj Palace here, IIA delegation had a useful discussions on bilateral trade with Ambassador of Brazil to India Andre Aranha Correa do Lago, Minister of Agriculture of Brazil Tereza Cristina and CEO of the Brazilian Association for Animal Protein (ABPA) and the trade delegates from Brazil.

Ghana

Eddison Mensah Agbenyegah, head of mission at Ghana embassy in India has said that Ghana will focus on Northeast in coming years.

''Ghana is open for investment from the Northeast. We have been holding meetings in different cities of the country. Now we will focus on the Northeast in the next few years,'' he said, on Friday, while speaking at the three-day first international summit and trade fair organised by Micro, Small and Medium Enterprises, (MSME) Export Promotion Council, here. The meet was held for aspiring entrepreneurs in the Northeast to pave the way for development of entrepreneurship and businesses by women and youths of the region.

Assam is hosting the international summit which will focus on health, tourism, food and food processing, organic food, IT/ITES, infrastructure, horticulture, handicrafts, and handloom for start-ups.

Delegates from African countries, Myanmar and Israel participated in the summit.

|

|

|

|

|

|

FISME’s official Twitter handle @fisme |

|

KNN India’s official Twitter handle @knnindia |

|

|

|

| Other Events |

OTM

Date: 03 - 05 Feb 2020

Venue: Bombay Exhibition Centre (BEC), Mumbai

See Details

India Food Forum

Date: 05 - 06 Feb 2020

Venue: Renaissance Mumbai Convention Centre Hotel, Mumbai

See Details

DEFEXPO INDIA

Date: 05 - 08 Feb 2020

Venue: Vrindavan Yojna, Lucknow

See Details

Home and Personal Care Ingredients Exhibition and Conference

Date: 06 - 07 Feb 2020

Venue: Bombay Exhibition Centre (BEC), Mumbai

See Details

AutoExpo Component Show

Date: 06 - 09 Feb 2020

Venue: Pragati Maidan, New Delhi

See Details

Water Expo - Bengaluru

Date: 06 - 08 Feb 2020

Venue: Manpho Convention Center - Conventions & Banquets, Bengaluru

See Details

Auto Expo - The Motor Show

Date: 07 - 12 Feb 2020

Venue: India Exposition Mart, Greater Noida

See Details

|

| Your Views |

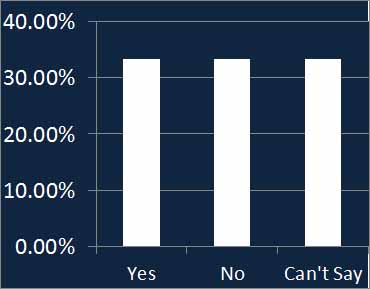

Will the Budget 2020-21 address MSME concerns of access to finance and payment delays?

According to FISME factor 33.3% MSMEs think that the Budget 2020-21 will address MSME concerns of access to finance and payment delays, 33.3% think that it will not while 33.3% think otherwise.

|

| Knowledge Store |

HR Heuristics

How do I correct discipline issues in my team?

We have been an authoritarian society for decades in the past. The corporate culture used to exhibit similar values but things have started shifting to a more democratic way of life in companies. While everyone has a right to speak up and express themselves, there is still a need for some ground rules and discipline to keep things working in order.

|

Finance Fundamentals

4 Money Budgeting Habits to Empower You as a Solopreneur

Running a business by yourself, as exciting as it is, doesn’t come without its challenges. It can be nebulous to learn how to budget expenses, figure out when to take a salary (and how much), and plan ahead when you don’t know what income in the coming months will look like. And you aren’t alone — Clutch reported that 61% of small businesses didn’t have a documented budget in 2018.

|

|

Marketing Mantras

Along with growth, focus on brand architecture

In 2015, Google went through restructuring and a new corporate brand, Alphabet Inc. was created. Many divisions that operate in businesses other than Internet services became subsidiaries of Alphabet. In 2007, Apple Computer, Inc. dropped ‘Computer’ from its name and became Apple Inc., because the company had shifted its emphasis from computers to consumer electronics with brands like iPod, Apple TV and iPhone.

|

|

Policy Polemic

MSMEs in J&K on verge of closure due to non-availability of fiscal incentives

The Federation of Industries Jammu (FoIJ) has said that Micro Small and Medium Enterprises (MSMEs) are on the verge of closure due to non- availability of state fiscal incentives.

|

|

SME Special

Started as a dorm project at Princeton, this agritech startup is now a tech supply chain for 55k Indian farmers

Aditya Agarwalla, a computer science undergrad student at Princeton, was back home in Delhi-NCR for his school break.

At dinner one night, he happened to have a long conversation with his father, Sanjay K Agarwalla, on the challenges Indian farmers faced while looking to sell their crops.

|

|

Success Story

In the times of Pepperfry and UrbanLadder, Jaipur’s Wooden Street is bringing customised furniture to the world

Siblings and cousins Lokendra Singh Ranawat, Dinesh Pratap Singh, and Virendra Singh Ranawat had realised one thing when they were looking at the world of furniture – the need for customised furniture would never die. Even with the different online platforms, they knew the need for personalisation would always be there. And hence, they started Wooden Street in Jaipur in 2015.

|

Stockpile

The National Statistical Office (NSO), Ministry of Statistics and Programme Implementation has released the First Revised Estimates of National Income, Consumption Expenditure, Saving and Capital Formation for the financial year 2018-19 along with Second Revised Estimates for the financial year 2017-18 and Third Revised Estimates for the financial year 2016-17(with Base Year 2011-12)

|

Quotable Quotes

“

Growth is painful. Change is painful. But, nothing is as painful as staying stuck where you do not belong.

”

– - N.R. Narayana Murthy - An Indian Business Magnate and Co-founder of Infosys

|

| Country Chronicles |

|

FISME regularly receives monthly reports on the economies of various countries from their missions in India. These reports provide information on key economic parameters, trade related information and all news relevant for importers and exporters. In this edition you can take a look at reports on:

|

| Reader Reactions |

Write and Win prize!

Write your comments on the FISME Factor. Share your views and suggestions on MSME issues. Win prize! The best mail will get a special book every fortnight.

send mail to: newsletter@fisme.org.in

|

| Editorial Team: |

Hon. Editor: Anil Bhardwaj

Asstt. Editor: Kalpana Sharma

Types setting & websdesigning: Sanjay Sachan

Video & Photography: Subhan Khan

|

|

|

|

You are receiving this Newsletter because you are included in our mailing list of recipients who are involved or interested in FISME or Indian MSMEs. You are welcome to partly or fully reproduce and disseminate the contents of this publication provided that you acknowledge the source.

To subscribe/unsubscribe to this Newsletter

click subscribe or unsubscribe

This Newsletter is edited by the FISME Secretariat. We welcome contributions as well as comments and suggestions. Please write to newsletter@fisme.org.in |

|

|

|

Bangalore

57/5, Family YMCA Building,

Millers Road, Benson Town,

Bangalore - 560046

Tel: +91-80-23543589

Email: bangalore@fisme.org.in

|

Hyderabad

H. No. 6-3-569 / 1/2/4

2nd floor, Rockdale Compound, Somajiguda

Hyderabad – 500082

Tel: +91- 40- 23322117 Fax: +91 -40- 23312116

Email: hyderabad@fisme.org.in

|

|

|

| |

Jhandewalan

Tel: +91- 11- 4364 2013

Email: chamber.jw@fisme.org.in

|

Mahipalpur

Tel: +91 -11- 46035866

Email: chamber.mpur@fisme.org.in

|

Kalkaji

Tel: +91 -11- 4106 8644

Email: kalkaji@fisme.org.in

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|